UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of Registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification no.) |

|

|

(Address of principal executive offices) |

(Zip code) |

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

|

Trading symbol |

|

Name of each exchange on which registered |

|

|

The |

||

|

|

The |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.:

Large accelerated filer |

|

☐ |

Accelerated filer |

|

☐ |

|

|

|

|

|

|

|

☑ |

Smaller reporting company |

|

||

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $

The registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2024 annual meeting of stockholders, which the registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year ended December 31, 2023, are incorporated by reference into Part III of this Annual Report on Form 10-K.

1

GENERATION INCOME PROPERTIES, INC.

TABLE OF CONTENTS

|

|

Page |

|

|

|

|

6 |

|

|

|

|

6 |

||

12 |

||

32 |

||

Item 1C. |

Cybersecurity |

32 |

33 |

||

34 |

||

34 |

||

|

|

|

|

35 |

|

|

|

|

35 |

||

35 |

||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

36 |

|

46 |

||

47 |

||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

77 |

|

77 |

||

77 |

||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

77 |

|

|

|

|

|

78 |

|

|

|

|

78 |

||

78 |

||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

78 |

|

Certain Relationships and Related Transactions, and Director Independence |

78 |

|

78 |

||

|

|

|

|

78 |

|

|

|

|

78 |

||

83 |

||

|

|

|

84 |

||

2

Note Regarding Company References

In this Annual Report on Form 10-K (“Form 10-K”), references to the “Company,” “we,” “us,” “our” or similar terms refer to Generation Income Properties, Inc., a Maryland corporation, together with its consolidated subsidiaries, including Generation Income Properties, L.P., a Delaware limited partnership, which we refer to as our operating partnership (the “Operating Partnership”). As used in this Form 10-K, an affiliate, or person affiliated with a specified person, is a person that directly or indirectly, through one or more intermediaries, controls or is controlled by, or is under common control with, the person specified.

Cautionary Note Regarding Forward‑Looking Statements and Summary Risk Factors

This Form 10-K contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements contained herein. When used in this report, the words "anticipate," "believe," "estimate," "expect" and similar expressions as they relate to the Company or its management are intended to identify such forward-looking statements. Actual results, performance or achievements could differ materially from the results expressed in, or implied by these forward-looking statements. Readers should be aware of important factors that, in some cases, have affected, and in the future could affect, actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of the Company. Factors that could have a material adverse effect on our forward-looking statements and upon our business, results of operations, financial condition, funds derived from operations, cash available for distribution, cash flows, liquidity and prospects include, but are not limited to, the factors under the heading “Risk Factors” in this Form 10-K and the following:

The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

3

Risk Factor Summary

Our business is subject to numerous risks and uncertainties, including those described in Part I, Item 1A. “Risk Factors” in this Annual Report. You should carefully consider these risks and uncertainties when investing in our common stock. The principal risks and uncertainties affecting our business include the following:

4

The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

Note Regarding Market and Industry Data

In this Form10-K, we present certain market and industry data and statistics. This information is based on third-party sources, which we believe to be reliable. We have not independently verified data from these sources and cannot guarantee their accuracy or completeness. While we are not aware of any misstatements regarding industry data provided herein, our estimates involve risks and uncertainties and are subject to change based upon various factors, including those discussed in this Annual Report under “Forward-Looking Statements” and Part I, Item 1A. “Risk Factors.” Additionally, some data in this Annual Report is based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. Similarly, we believe our internal research is reliable, however, such research has not been verified by any independent sources.

5

PART I.

ITEM 1. BUSINESS

Our Company

We are an internally managed real estate investment trust focused on acquiring and managing income-producing retail, office and industrial properties net leased to high quality tenants in major markets throughout the United States. We believe our focus on owning properties leased to investment grade or creditworthy tenants provide attractive risk adjusted returns through current yields, long term appreciation and tenant renewals.

We believe that single-tenant commercial properties, as compared with shopping centers, malls, and other traditional multi-tenant properties, offer a distinct investment advantage since single-tenant properties generally require less management and operating capital and generally have less recurring tenant turnover.

Given the stability and predictability of the cash flows, many net leased properties are held in family trusts, providing us an opportunity to acquire these properties for tax deferred units while giving the owners potential liquidity through the conversion of the units for freely tradable shares of stock.

We make regular cash distributions to our stockholders out of our cash available for distribution, typically on a monthly basis. Generally, our policy will be to pay distributions from cash flow from operations. However, our distributions may be paid from sources other than cash flows from operations, such as from the proceeds from a capital raise, borrowings or distributions in kind.

We have been organized as a Maryland corporation and have operated in conformity with the requirements for qualification and taxation as a REIT under U.S. federal income tax laws since the beginning of our taxable year ended December 31, 2021. The Company formed a Maryland entity GIP TRS Inc. in 2022 to operate as a taxable REIT subsidiary but this subsidiary does not hold any assets or business operations as of the date of this Form 10-K.

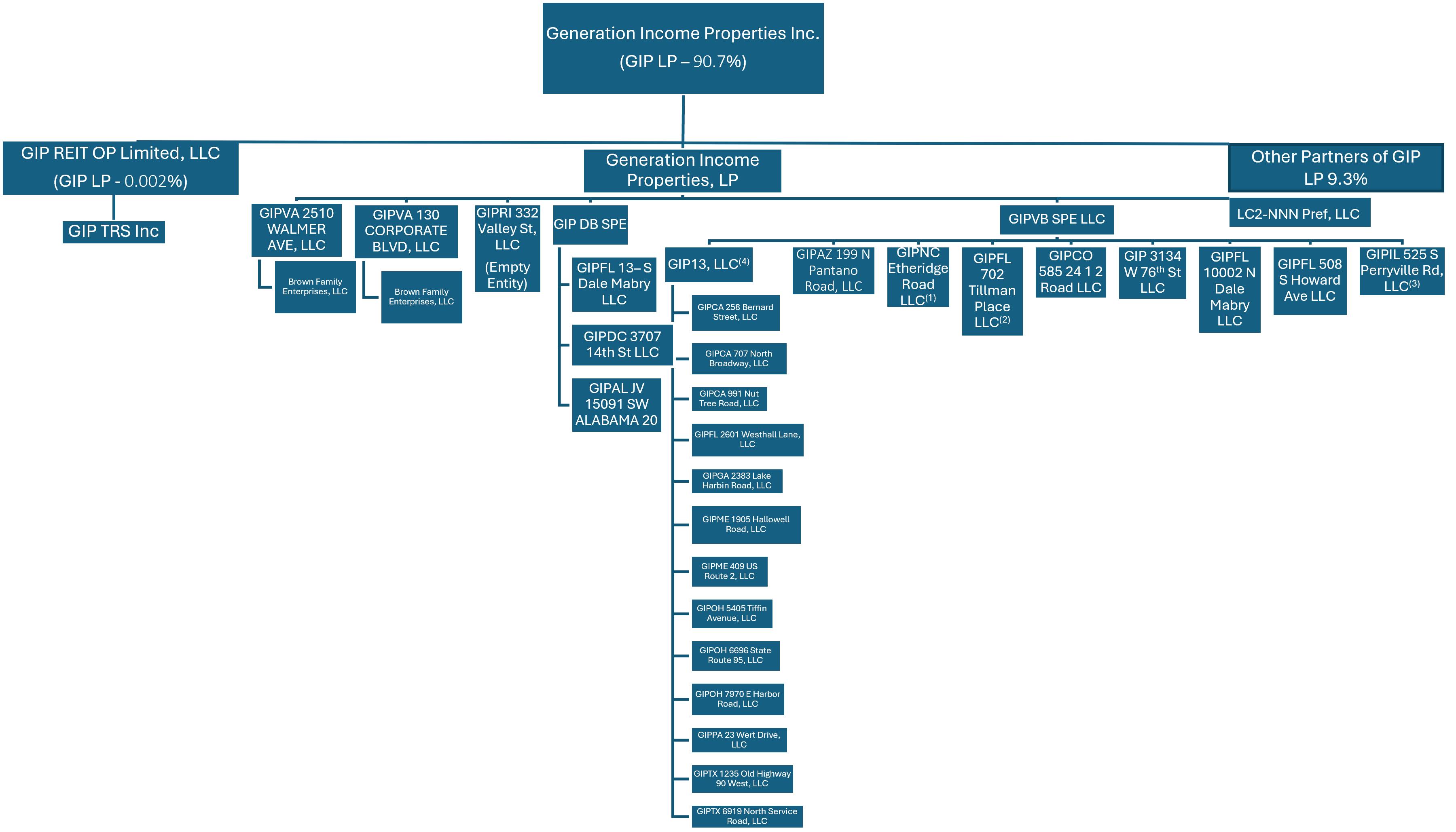

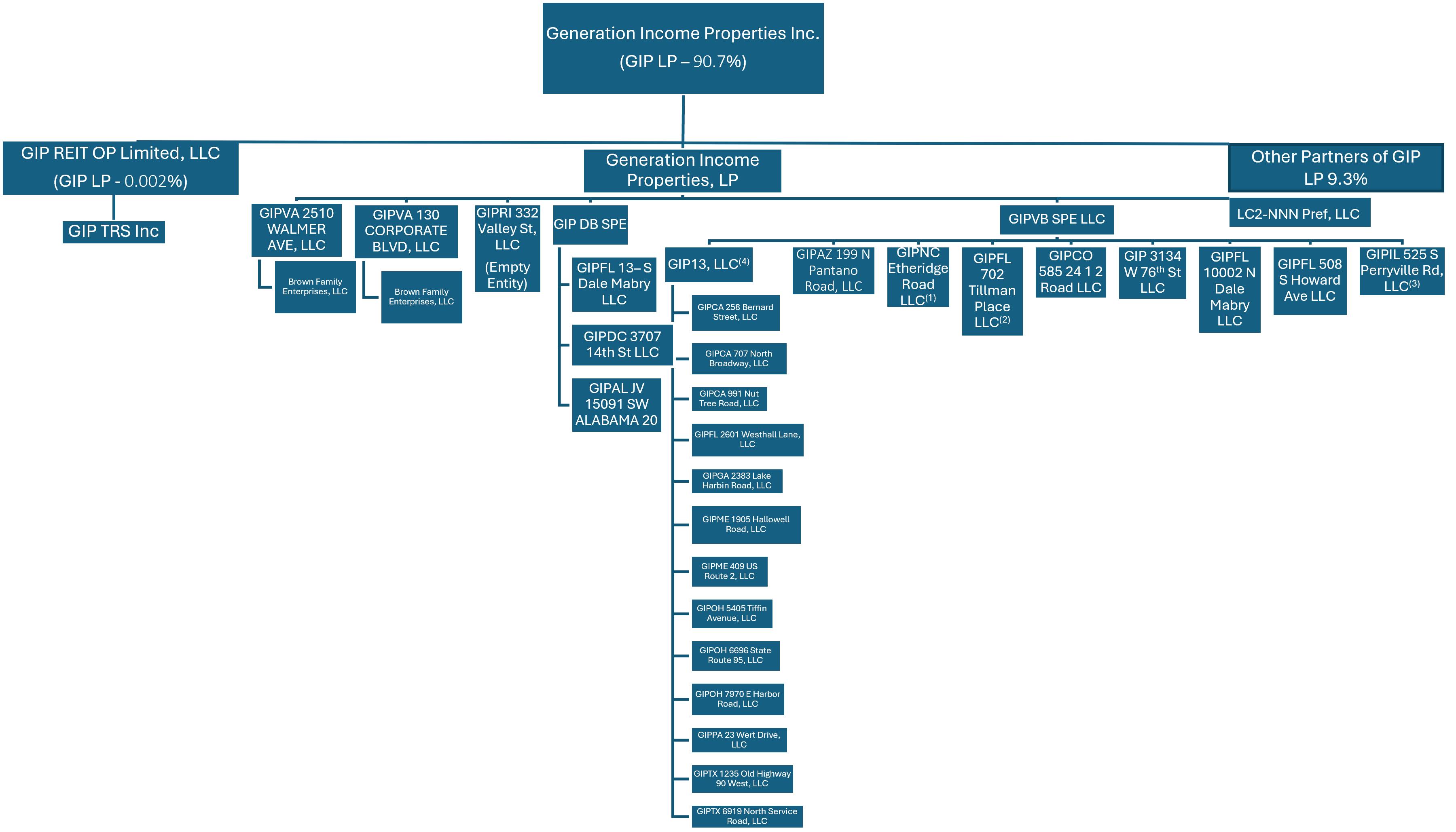

We and our Operating Partnership were organized to operate using an Umbrella Partnership Real Estate Investment Trust (“UPREIT”) structure. We use an UPREIT structure because a sale of property directly to another person or entity generally is a taxable transaction to the selling property owner. In an UPREIT structure, a seller of a property that desires to defer taxable gain on the sale of its property may transfer the property to the Operating Partnership in exchange for common units in the Operating Partnership and defer taxation of gain until the seller later disposes of its common units in the Operating Partnership. Using an UPREIT structure may give us an advantage in acquiring desired properties from persons who may not otherwise sell their properties because of unfavorable tax results. Substantially all of the Company’s assets are held by, and operations are conducted through, the Operating Partnership or its direct or indirect subsidiaries. As of December 31, 2023, as the general partner of the Operating Partnership, we owned 90.7% of the outstanding common units in the Operating Partnership and outside investors owned 9.3%. The Company formed a Maryland entity GIP REIT OP Limited LLC as a wholly owned subsidiary in 2018 that owned 0.002% of the Operating Partnership as of December 31, 2023.

The following chart shows the structure of the Company as of December 31, 2023:

6

(1) Until August 8, 2023 The Brown Family owned redeemable liability company interests in GIPNC 199 N Etheridge Road LLC. The Company has since purchased the Brown Family's interest and as of the reporting date owns 100% of the entity.

(2) Until August 8, 2023 Richard Hornstrom and Stephen Brown owned redeemable limited liability company member interests in GIPFL 702 Tillman Place LLC. The Company has purchased each of Mr. Hornstrom and Mr. Brown’s interests, in full, and as of the reporting date, owns 100% of the entity.

(3) Until September 7, 2023 Richard Hornstrom owned a redeemable limited liability company interest in GIPIL 525 S Perryville Rd, LLC. The Company has since purchased Mr. Hornstrom’s interest and as of the reporting date owns 100% of the entity.

(4) On August 10, 2023 the company acquired a 13 property portfolio, now GIP13, LLC, from Modiv Inc. for a purchase price of $42 million. The acquired portfolio consists of eleven (11) retail and two (2) office properties.

Business Objectives and Investment Strategy

We intend to continue to acquire and manage a diversified portfolio of high-quality net leased properties that generates predictable cash flows and capital appreciation over market cycles. Our properties are generally net leased to a single tenant. Under a net lease, the tenant typically bears the responsibility for most or all property related expenses such as real estate taxes, insurance, and maintenance costs. We believe this lease structure provides us with stable cash flows over the term of the lease and minimizes the ongoing capital expenditures. We seek to identify properties in submarkets with high barriers to entry for development and where valuation is frequently influenced by local real estate market conditions and tenant needs

Focus on Real Estate Fundamentals: We have observed that the market for properties with bond type net leased structures, lease terms greater than ten years, and limited rent escalators upon renewal are exposed to many of the same operational and market risks as other net leased properties while providing lower returns due to competition. We believe that focusing on traditional real estate fundamentals allows us to target properties with shorter lease terms, modified net leases or vacancy and thereby may allow us to generate superior returns.

Target Markets with Attractive Characteristics: We concentrate our investment activity in select target markets with the following characteristics: high quality infrastructure, diversified local economies with multiple economic drivers, strong demographics, pro-business local governments and high-quality local labor pools. We believe that these markets offer a higher probability of producing long term rent growth and capital appreciation.

Target Strategic Net Leased Properties: We target properties that offer unique strategic advantages to a tenant or an industry and can therefore be acquired at attractive yields relative to the underlying risk. We look for properties that are difficult or costly to replicate due to a specific location, special zoning, unique physical attributes, below market rents or a significant tenant investment in the facility, all of

7

which contribute to a higher probability of tenant renewals. An example of a specialized property is our General Services Administration occupied building in Norfolk, Virginia due to the tenant’s buildout for IT and security. We target properties if we believe they are critical to the ongoing operations of the tenant and the profitability of its business. We believe that the profitability of the operations and the difficulty in replicating or moving operations reflect the importance of the property to the tenant’s business.

Target Investments that Maximize Growth Potential: We focus on net leased investment properties where, in our view, there is the potential to invest incremental capital to accommodate a tenant’s business, extend lease terms and increase the value of a property. We believe these opportunities can generate attractive returns due to the nature of our relationship with the tenant.

Disciplined Underwriting & Risk Management

We actively manage and regularly review each of our properties for changes in the underlying business, credit of the tenant and market conditions. Before acquiring a property, we review the terms of the management contract to ensure our team is able to maximize cash flow capital appreciation through potential lease renewals and/or potential re-tenanting. Additionally, we monitor any required capital improvements that would lead to increased rental income or capital appreciation over time. We focus on active management with the tenants upon the acquisition of an asset since our experience in the single-tenant, commercial real estate industry indicates that active management and fostering tenant relationships has the potential to positively impact long-term financial outcomes, such as:

Underwriting Process

Our extensive underwriting process evaluates key fundamental value drivers that we believe will attract long-term tenants and result in property appreciation over time. Our Investment Committee is comprised of the following members:

This comprehensive pre-ownership analysis helps us to assess location level performance, including the possible longevity of tenant occupancy throughout the primary lease term and option periods. Additionally, each acquisition pursuit requires approval from all four members of the Investment Committee.

We assess target markets and properties using an extensive underwriting and evaluation process, including:

8

Competitive Strengths

We believe that the following factors benefit the Company as we implement our business strategy:

Financing Strategies

Our long-term goal is to maintain a lower-leveraged capital structure and lower outstanding principal amount of our consolidated indebtedness. Over time, we intend to reduce our debt positions through financing our long-term growth with equity issuances and some debt financing having staggered maturities. Our debt may include mortgage debt secured by our properties and unsecured debt. Over a long-term period, we intend to maintain lower levels of debt encumbering the Company, its assets and/or the portfolio as compared to our current leverage.

Our Current Portfolio as of December 31, 2023

The following are characteristics of our properties as of December 31, 2023:

9

Given the nature of our leases, our tenants either pay the real estate taxes or insurance directly or reimburse us for such costs. We believe all of our properties are adequately covered by insurance.

For further information on our properties and our tenant base, see “Item 2–Properties.”

The table below presents an overview of the properties in our portfolio as of December 31, 2023:

Property Type |

Location |

Rentable Square Feet |

|

Tenant |

S&P Credit Rating (1) |

Remaining Term (Yrs) |

|

Options (Number x Yrs) |

Contractual Rent Escalations (5) |

ABR (2) |

|

ABR per Sq. Ft. |

|

||||

Retail |

Washington, D.C. |

|

3,000 |

|

7-Eleven Corporation |

A |

|

2.2 |

|

2 x 5 |

Yes |

$ |

129,804 |

|

$ |

43.27 |

|

Retail |

Tampa, FL |

|

2,200 |

|

Starbucks Corporation |

BBB+ |

|

4.2 |

|

4 x 5 |

Yes |

$ |

200,750 |

|

$ |

91.25 |

|

Industrial |

Huntsville, AL |

|

59,091 |

|

Pratt & Whitney Automation, Inc.(4) |

A- |

|

0.1 |

|

N/A |

N/A |

$ |

684,996 |

|

$ |

11.59 |

|

Office |

Norfolk, VA |

|

49,902 |

|

General Services Administration-Navy(7) |

AA+ |

|

4.7 |

|

N/A |

Yes |

$ |

926,923 |

|

$ |

18.57 |

|

Office |

Norfolk, VA |

|

22,247 |

|

VACANT(7) |

N/A |

|

- |

|

N/A |

N/A |

$ |

- |

|

$ |

- |

|

Office |

Norfolk, VA |

|

34,847 |

|

PRA Holdings, Inc. (3) |

BB+ |

|

3.7 |

|

1 x 5 |

Yes |

$ |

765,136 |

|

$ |

21.96 |

|

Retail |

Tampa, FL |

|

3,500 |

|

Sherwin Williams Company |

BBB |

|

4.6 |

|

5 x 5 |

Yes |

$ |

126,788 |

|

$ |

36.23 |

|

Office |

Manteo, NC |

|

7,543 |

|

General Services Administration-FBI |

AA+ |

|

5.1 |

|

1 x 5 |

Yes |

$ |

161,346 |

|

$ |

21.39 |

|

Office |

Plant City, FL |

|

7,826 |

|

Irby Construction |

BBB- |

|

1.0 |

|

2 x 5 |

Yes |

$ |

170,865 |

|

$ |

21.83 |

|

Retail |

Grand Junction, CO |

|

30,701 |

|

Best Buy Co., Inc. |

BBB+ |

|

3.2 |

|

1 x 5 |

Yes |

$ |

353,061 |

|

$ |

11.50 |

|

Medical-Retail |

Chicago, IL |

|

10,947 |

|

Fresenius Medical Care Holdings, Inc. |

BBB |

|

2.8 |

|

2 x 5 |

Yes |

$ |

228,902 |

|

$ |

20.91 |

|

Retail |

Tampa, FL |

|

2,642 |

|

Starbucks Corporation |

BBB+ |

|

3.2 |

|

2 x 5 |

Yes |

$ |

148,216 |

|

$ |

56.10 |

|

Retail |

Tucson, AZ |

|

88,408 |

|

Kohl's Corporation |

BB |

|

6.1 |

|

7 x 5 |

Yes |

$ |

823,962 |

|

$ |

9.32 |

|

Retail |

San Antonio, TX |

|

50,000 |

|

City of San Antonio (PreK) |

AAA |

|

5.6 |

|

1 x 8 |

Yes |

$ |

924,000 |

|

$ |

18.48 |

|

Retail |

Bakersfield, CA |

|

18,827 |

|

Dollar General Market |

BBB |

|

4.6 |

|

3 x 5 |

Yes |

$ |

361,075 |

|

$ |

19.18 |

|

Retail |

Big Spring, TX |

|

9,026 |

|

Dollar General |

BBB |

|

6.5 |

|

3 x 5 |

Yes |

$ |

86,040 |

|

$ |

9.53 |

|

Retail |

Castalia, OH |

|

9,026 |

|

Dollar General |

BBB |

|

11.4 |

|

3 x 5 |

Yes |

$ |

79,320 |

|

$ |

8.79 |

|

Retail |

East Wilton, ME |

|

9,100 |

|

Dollar General |

BBB |

|

6.6 |

|

3 x 5 |

Yes |

$ |

112,440 |

|

$ |

12.36 |

|

Retail |

Lakeside, OH |

|

9,026 |

|

Dollar General |

BBB |

|

11.4 |

|

3 x 5 |

Yes |

$ |

81,036 |

|

$ |

8.98 |

|

Retail |

Litchfield, ME |

|

9,026 |

|

Dollar General |

BBB |

|

6.8 |

|

3 x 5 |

Yes |

$ |

92,964 |

|

$ |

10.30 |

|

Retail |

Mount Gilead, OH |

|

9,026 |

|

Dollar General |

BBB |

|

6.5 |

|

3 x 5 |

Yes |

$ |

85,920 |

|

$ |

9.52 |

|

Retail |

Thompsontown, PA |

|

9,100 |

|

Dollar General |

BBB |

|

6.8 |

|

3 x 5 |

Yes |

$ |

86,004 |

|

$ |

9.45 |

|

Retail |

Morrow, GA |

|

10,906 |

|

Dollar Tree Stores, Inc. |

BBB |

|

1.6 |

|

3 x 5 |

Yes |

$ |

103,607 |

|

$ |

9.50 |

|

Office |

Maitland, FL |

|

33,118 |

|

exp U.S. Services Inc. |

Not Rated |

|

2.9 |

|

1 x 5 |

Yes |

$ |

835,346 |

|

$ |

25.22 |

|

Office |

Vacaville, CA |

|

11,014 |

|

General Services Administration |

AA+ |

|

2.6 |

|

N/A |

No |

$ |

343,665 |

|

$ |

31.20 |

|

Retail |

Santa Maria, CA |

|

14,490 |

|

Walgreens (6) |

BBB |

|

8.3 |

|

N/A |

No |

$ |

369,000 |

|

$ |

25.47 |

|

Retail |

Rockford, IL |

|

15,288 |

|

La-Z-Boy Inc. |

Not Rated |

|

3.8 |

|

4 x 5 |

Yes |

$ |

366,600 |

|

$ |

23.98 |

|

Tenants - All Properties |

|

|

539,827 |

|

|

|

|

|

|

|

$ |

8,647,766 |

|

$ |

16.02 |

|

|

Acquisition Pipeline

We are continually engaging in internal research as well as informal discussions with various parties regarding our potential interest in potential acquisitions that fall within our target market. There is no assurance that any currently available properties in our acquisition pipeline will remain available, or that we will pursue or complete potential acquisitions, at prices acceptable to us or at all.

10

Property and Asset Management Agreements

We manage our properties in-house, except for our Norfolk, Virginia properties and our Maitland, Florida property.

We previously engaged Colliers International Asset Services to provide property management services to our two properties in Norfolk, Virginia. The agreements provided for us to pay Colliers International Asset Services a management fee equal to 2.5% of the gross collected rent of each of the two properties (inclusive of tenant expense reimbursements) as well as a construction supervision fee for any approved construction. On May 31, 2022, the Company terminated the agreement with Colliers International Asset Services effective June 30, 2022. The Company engaged Bevara Building Services for facility management and property management services for the two Norfolk, Virginia properties from June 15, 2022 through July 2023. Effective August 2023 Colliers International Asset Services resumed management services for our Norfolk, VA properties for an aggregate of approximately $42,000 annually, as well as, for our Maitland, Florida property for approximately $24,000 annually.

Distributions

From inception through December 31, 2023, we have distributed $3,872,035 to common stockholders. In addition, on January 3, 2024, we announced that our Board of Directors authorized a distribution of $0.039 per share monthly cash distribution for shareholders of record of our common stock as of January 15, 2024, February 15, 2024 and March 15, 2024. January and February distributions were paid on January 30, 2024, February 29, 2024 and March 29, 2024, respectively. Because we have not yet generated a cumulative profit, distributions have been made from proceeds from prior capital raises.

Competition

The net lease industry is highly competitive. We compete to acquire properties with other investors, including traded and non-traded public REITs, private equity investors and institutional investment funds, many of which have greater financial resources than we do, a greater ability to borrow funds to acquire properties and the ability to accept more risk than we can prudently manage. This competition increases the demand for the types of properties in which we wish to invest and, therefore, reduces the number of suitable acquisition opportunities available to us and increases the prices paid for such acquisition. This competition will increase if investments in real estate become more attractive relative to other forms of investment.

As a landlord, we compete for tenants in the multi-billion dollar commercial real estate market with numerous developers and owners of properties, many of which own properties similar to ours in the same markets in which our properties are located. Many of our competitors have greater economies of scale, access to more resources and greater name recognition than we do. If our competitors offer space at rental rates below current market rates or below the rental rates we charge our tenants, we may lose our tenants or prospective tenants and we may be pressured to reduce our rental rates or to offer substantial rent abatements, tenant improvement allowances, early termination rights or below-market renewal options in order to retain tenants when our leases expire.

Human Capital

As of December 31, 2023 we had four full-time employees. We plan to use outside consultants, attorneys, and accountants, as necessary. We endeavor to maintain workplaces that are free from discrimination or harassment on the basis of color, race, sex, national origin, ethnicity, religion, age, disability, sexual orientation, gender identification or expression or any other status protected by applicable law. The basis for recruitment, hiring, development, training, compensation and advancement is a person’s qualifications, performance, skills and experience. Our employees are fairly compensated, without regard to gender, race and ethnicity, and routinely recognized for outstanding performance.

Environmental Matters

To control costs, we limit our investments to properties that are environmentally compliant or that do not require extensive remediation upon acquisition. To do this, we conduct assessments of properties before we decide to acquire them. These assessments, however, may not reveal all environmental hazards. In certain instances we rely upon the experience of our management and n most cases we will request, but will not always obtain, a representation from the seller that, to its knowledge, the property is not contaminated with hazardous materials. Additionally, we seek to ensure that many of our leases contain clauses that require a tenant to reimburse and indemnify us for any environmental contamination occurring at the property. We do not intend to purchase any properties that have known environmental deficiencies that cannot be remediated.

Federal, state and local environmental laws and regulations regulate, and impose liability for, releases of hazardous or toxic substances into the environment. Under these laws and regulations, a current or previous owner, operator or tenant of real estate may be required to investigate and clean up hazardous or toxic substances, hazardous wastes or petroleum product releases or threats of releases at the property, and may be held liable to a government entity or to third parties for property damage and for investigation, cleanup and monitoring costs incurred by those parties in connection with the actual or threatened contamination. These laws typically impose cleanup responsibility and

11

liability without regard to fault, or whether or not the owner, operator or tenant knew of or caused the presence of the contamination. The liability under these laws may be joint and several for the full amount of the investigation, cleanup and monitoring costs incurred or to be incurred or actions to be undertaken, although a party held jointly and severally liable may seek to obtain contributions from other identified, solvent, responsible parties of their fair share toward these costs. In addition, under the environmental laws, courts and government agencies have the authority to require that a person or company who sent waste to a waste disposal facility, such as a landfill or an incinerator, must pay for the cleanup of that facility if it becomes contaminated and threatens human health or the environment. Any of these cleanup costs may be substantial, and can exceed the value of the property. The presence of contamination, or the failure to properly remediate contamination, on a property may adversely affect the ability of the owner, operator or tenant to sell or rent that property or to borrow using the property as collateral, and may adversely impact our investment in that property.

Furthermore, various court decisions have established that third parties may recover damages for injury caused by property contamination. For instance, a person exposed to asbestos while occupying a net lease may seek to recover damages if he or she suffers injury from the asbestos. Lastly, some of these environmental laws restrict the use of a property or place conditions on various activities. An example would be laws that require a business using chemicals (such as swimming pool chemicals at a net lease property) to manage them carefully and to notify local officials that the chemicals are being used.

We could be responsible for any of the costs discussed above. The costs to clean up a contaminated property, to defend against a claim, or to comply with environmental laws could be material and could adversely affect the funds available for distribution to our shareholders. Prior to any acquisition of property, we will seek to obtain environmental site assessments to identify any environmental concerns at the property. However, these environmental site assessments may not reveal all environmental costs that might have a harmed our business, assets, results of operations or liquidity and may not identify all potential environmental liabilities.

As a result, we may become subject to material environmental liabilities of which we are unaware. We can make no assurances that (1) future laws or regulations will not impose material environmental liabilities on us, or (2) the environmental condition of our net lease properties will not be affected by the condition of the properties in the vicinity of our net lease properties (such as the presence of leaking underground storage tanks) or by third parties unrelated to us.

Insurance

We require our tenant, up to the limits stated in our leases, to maintain liability and property insurance coverage for the properties they lease from us pursuant to net leases. Pursuant to the leases, our tenants may be required to name us (and any of our lenders that have a mortgage on the property leased by the tenant) as additional insureds on their liability policies and additional named insured and/or loss payee (or mortgagee, in the case of our lenders) on their property policies. All tenants are required to maintain casualty coverage. Depending on the location of the property, losses of a catastrophic nature, such as those caused by earthquakes and floods, may be covered by insurance policies that are held by our tenants with limitations such as large deductibles or co-payments that a tenant may not be able to meet. In addition, losses of a catastrophic nature, such as those caused by wind/hail, hurricanes, terrorism or acts of war, may be uninsurable or not economically insurable. In the event there is damage to any of our properties that is not covered by insurance and such properties are subject to recourse indebtedness, we will continue to be liable for any indebtedness, even if these properties are irreparably damaged. In addition to being a named insured on our tenants’ liability policies, we intend to separately maintain commercial general liability coverage with an aggregate limit of $2,000,000. We also intend to maintain full property coverage on all untenanted properties and any other property coverage required by any of our lenders that is not required to be carried by our tenants under our leases.

Available Information

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the U.S. Securities and Exchange Commission (the “SEC”). Such reports and other information filed by the Company with the SEC are available free of charge on the SEC’s website, www.sec.gov. The Company periodically provides other information for investors on its corporate website, www.gipreit.com, and its investor relations website, ir.gipreit.com. This includes press releases and other information about financial performance, information on environmental, social and corporate governance and details related to the Company’s annual meeting of shareholders. The information contained on the websites referenced in this Form 10-K is not incorporated by reference into this filing. Further, the Company’s references to website URLs are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

The Company’s business, reputation, results of operations and financial condition, as well as the price of the Company’s stock, can be affected by a number of factors, whether currently known or unknown, including those described below. When any one or more of these risks materialize from time to time, the Company’s business, reputation, results of operations and financial condition, as well as the price of the Company’s stock, can be materially and adversely affected.

Because of the following factors, as well as other factors affecting the Company’s results of operations and financial condition, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods. This discussion of risk factors contains forward-looking statements.

12

This section should be read in conjunction with Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and accompanying notes in Part II, Item 8, “Financial Statements and Supplementary Data” of this Form 10-K.

Risks Related to Our Business and Properties

We have limited operating history and may not be able to successfully operate our business or generate sufficient operating cash flows to make or sustain distributions to our stockholders.

We were organized in September 2015 for the purpose of acquiring and investing in freestanding, single-tenant commercial properties net leased to investment grade tenants. We commenced operations as soon as we were able to raise sufficient funds to acquire our first suitable property. However, our ability to make or sustain distributions to our stockholders will depend on many factors, including our ability to identify attractive acquisition opportunities that satisfy our investment strategy, our success in consummating acquisitions on favorable terms, the level and volatility of interest rates, readily accessible short-term and long-term financing on favorable terms, and conditions in the financial markets, the real estate market and the economy. We will face competition in acquiring attractive net lease properties. The value of the net lease properties that we acquire may decline substantially after we purchase them. We may not be able to successfully operate our business or implement our operating policies and investment strategy successfully. Furthermore, we may not be able to generate sufficient operating cash flow to pay our operating expenses and make distributions to our stockholders.

As an early-stage company, we are subject to the risks of any early stage business enterprise, including risks that we will be unable to attract and retain qualified personnel, create effective operating and financial controls and systems or effectively manage our anticipated growth, any of which could have a harmful effect on our business and our operating results.

We currently own twenty-six properties.

As of March 29, 2024, we own twenty-six properties. We will need to raise funds to acquire additional properties to lease in order to grow and generate additional revenue. Because we only own twenty-six properties, the loss of any one tenant (or financial difficulties experienced by one of our tenants) could have a material adverse impact on our business and operations.

Many of our current and future properties depend upon a single tenant for all or a majority of the rental income, and our financial condition and ability to make distributions may be adversely affected by the bankruptcy or insolvency, a downturn in the business, or a lease termination of a single tenant.

Current and future properties are occupied by only one tenant or derive a majority of their rental income from one tenant and, therefore, the success of those properties is materially dependent on the financial stability of such tenants. Lease payment defaults by tenants could cause us to reduce the amount of distributions we pay. A default of a tenant on its lease payments to us would cause us to lose the revenue from the property and force us to find an alternative source of revenue to meet any mortgage payment and prevent a foreclosure if the property is subject to a mortgage. In the event of a default, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment and re-letting the property. If a lease is terminated, there is no assurance that we will be able to lease the property for the rent previously received or sell the property without incurring a loss. A default by a tenant, the failure of a guarantor to fulfill its obligations or other premature termination of a lease, or a tenant’s election not to extend a lease upon its expiration, could have an adverse effect on our financial condition and our ability to pay distributions. For example, one tenant in one of our Norfolk, Virginia properties and another tenant in our Alabama property did not renew their leases that terminated on January 31, 2023 and January 31, 2024, respectively. Consequently, if we do not timely find replacement tenants for each, it may materially adversely impact our business.

We have experienced losses in the past, and we will likely experience similar losses in the near future.

From inception of the Company through December 31, 2023, we had a cumulative net loss of approximately $14.8 million. Our losses can be attributed, in part, to the initial start-up costs and high corporate general and administrative expenses as a public company relative to the size of our portfolio. In addition, acquisition costs and depreciation and amortization expenses substantially reduced our income. As we continue to acquire properties, we anticipate we will achieve scale to reduce these expenses; however, we cannot assure you that, in the future, we will be profitable or that we will realize growth in the value of our assets.

We may change our investment objectives without seeking stockholder approval.

We may change our investment objectives without stockholder notice or consent. Although our Board has fiduciary duties to our stockholders and intends only to change our investment objectives when our Board determines that a change is in the best interests of our stockholders, a change in our investment objectives could reduce our payment of cash distributions to our stockholders or cause a decline in the value of our investments.

We may not be successful in identifying and consummating suitable investment opportunities.

Our investment strategy requires us to identify suitable investment opportunities compatible with our investment criteria. We may not be successful in identifying suitable opportunities that meet our criteria or in consummating investments, including those identified as part of our investment pipeline, on satisfactory terms or at all. Our ability to make investments on favorable terms may be constrained by several factors including, but not limited to, competition from other investors with significant capital, including non-traded REITs, publicly-traded REITs and institutional investment funds, which may significantly increase investment costs; and/or the inability to finance an investment on favorable terms or at all. The failure to identify or consummate investments on satisfactory terms, or at all, may impede our growth and negatively affect our cash available for distribution to our stockholders.

13

If we cannot obtain additional capital, our ability to make acquisitions and lease properties will be limited. We are subject to risks associated with debt and capital stock issuances, and such issuances may have adverse consequences to holders of shares of our common stock.

Our ability to acquire and lease properties will depend, in large part, upon our ability to raise additional capital. If we were to raise additional capital through the issuance of equity securities, we could dilute the interests of holders of shares of our common stock. Our Board may authorize the issuance of classes or series of preferred stock which may have rights that could dilute, or otherwise adversely affect, the interest of holders of shares of our common stock.

Further, we expect to incur additional indebtedness in the future, which may include a new corporate credit facility. Such indebtedness could also have other important consequences to our creditors and holders of our common and preferred stock, including subjecting us to covenants restricting our operating flexibility, increasing our vulnerability to general adverse economic and industry conditions, limiting our ability to obtain additional financing to fund future working capital, capital expenditures and other general corporate requirements, requiring the use of a portion of our cash flow from operations for the payment of principal and interest on our indebtedness, thereby reducing our ability to use our cash flow to fund working capital, acquisitions, capital expenditures and general corporate requirements, and limiting our flexibility in planning for, or reacting to, changes in our business and our industry.

The Amended and Restated Limited Liability Company Agreement for GIP SPE, entered into by the Operating Partnership and LC2, contains provisions that could significantly impede our operations and our ability to efficiently manage our business and that could materially and adversely affect our financial condition, results of operations and cash flows, the trading price of our common stock and our ability to pay dividends to our common stockholders in the future.

In connection with the preferred investment by LC2 in our GIP SPE subsidiary, LC2 has substantial rights under the Amended and Restated Limited Liability Company Agreement for GIP SPE (the “GIP SPE Operating Agreement”). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations-- Recent Developments.”

GIP SPE is a subsidiary of our Operating Partnership, which holds, directly and indirectly, 21 of our properties, including the properties comprising our portfolio acquisition from Modiv Industrial and eight of our other properties (collectively, the “Properties”). Under the GIP SPE Operating Agreement, the following actions, among others, require the approval of LC2:

GIP SPE’s Preferred Interest has a cumulative accruing distribution preference of 15.5% per year, compounded monthly, a portion of which, in the amount of 5% per annum, is deemed to be the “current preferred return,” and the remainder of which, in the amount of 10.5% per annum, is deemed to be the “accrued preferred return.” The GIP SPE Operating Agreement provides that operating distributions by GIP

14

SPE will be made first to LC2 to satisfy any accrued but unpaid current preferred return, with the balance being paid to the Operating Partnership, subject to certain exceptions. The GIP SPE Operating Agreement also provides that distributions from capital transactions will be paid first to LC2 to satisfy any accrued but unpaid preferred return, then to LC2 until the “Make-Whole Amount” (defined as an amount equal to 1.3 times the LC2 Investment) is reduced to zero, and then to the Operating Partnership.

LC2’s rights under the GIP SPE Operating Agreement may significantly impede our ability to operate our business and manage our Properties. Furthermore, these rights may prevent us from engaging in transactions, including change of control or financing transactions, that otherwise would be attractive to us. The foregoing could adversely affect our financial condition, results of operations and cash flows, the market value of our common stock and our ability to pay dividends to our common stockholders in the future.

We may never reach sufficient size to achieve diversity in our portfolio.

We are presently a comparatively small company with only twenty-six properties, resulting in a portfolio that lacks geographic and tenant diversity. While we intend to endeavor to grow and diversify our portfolio through additional property acquisitions, we may never reach a significant size to achieve true portfolio diversity. In addition, because we intend to focus on single-tenant properties, we may never have a diverse group of tenants renting our properties, which will hinder our ability to achieve overall diversity in our portfolio. As of March 29, 2024, 40% of our total base rent is derived from our office properties and 60% from retail/medical-retail properties.

The market for real estate investments is highly competitive.

Identifying attractive real estate investment opportunities, particularly in the value-added real estate arena, is difficult and involves a high degree of uncertainty. Furthermore, the historical performance of a particular property or market is not a guarantee or prediction of the property’s or market’s future performance. There can be no assurance that we will be able to locate suitable acquisition opportunities or achieve our investment goal and objectives.

Because there are consistently periods of different levels of demand for real estate investments, there may be increased competition among investors to invest in the same asset classes as the Company. This competition may lead to an increase in the investment prices or otherwise less favorable investment terms. If this situation occurs with a particular investment, our return on that investment is likely to be less than the return it could have achieved if it had invested at a time of less investor competition for the investment.

We are required to make a number of judgments in applying accounting policies, and different estimates and assumptions in the application of these policies could result in changes to our reporting of financial condition and results of operations.

Various estimates are used in the preparation of our financial statements, including estimates related to asset and liability valuations (or potential impairments) and various receivables. Often these estimates require the use of market data values that may be difficult to assess, as well as estimates of future performance or receivables collectability that may be difficult to accurately predict. While we have identified those accounting policies that are considered critical and have procedures in place to facilitate the associated judgments, different assumptions in the application of these policies could result in material changes to our financial condition and results of operations.

Because of our holding company structure, we depend on our Operating Partnership subsidiary and its subsidiaries for cash flow and we will be structurally subordinated in right of payment to the obligations of such Operating Partnership subsidiary and its subsidiaries.

We are a holding company with no business operations of our own. Our only significant asset is and will be the general and limited partnership interests in our Operating Partnership. We conduct, and intend to conduct, all our business operations through our Operating Partnership. Accordingly, our only source of cash to pay our obligations is distributions from our Operating Partnership and its subsidiaries of their net earnings and cash flows. We cannot assure our stockholders that our Operating Partnership or its subsidiaries will be able to, or be permitted to, make distributions to us that will enable us to make distributions to our stockholders from cash flows from operations. Each of our Operating Partnership's subsidiaries is or will be a distinct legal entity and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from such entities. In addition, because we are a holding company, your claims as stockholders will be structurally subordinated to all existing and future liabilities and obligations of our Operating Partnership and its subsidiaries. Therefore, in the event of our bankruptcy, liquidation or reorganization, our assets and those of our Operating Partnership and its subsidiaries will be able to satisfy your claims as stockholders only after all our and our Operating Partnership's and its subsidiaries' liabilities and obligations have been paid in full.

We may incur losses as a result of ineffective risk management processes and strategies.

We seek to monitor and control our risk exposure through a risk and control framework encompassing a variety of separate but complementary financial, credit, operational, compliance and legal reporting systems, internal controls, management review processes and other mechanisms. While we employ a broad and diversified set of risk monitoring and risk mitigation techniques, those techniques and the judgments that accompany their application cannot anticipate every economic and financial outcome or the specifics and timing of such outcomes. In addition, with a limited number of employees, our ability to identify risks is limited. Thus, we may, in the course of our activities, incur losses due to these risks.

You will not have the opportunity to evaluate our investments before we make them.

Our investment policies and strategies are very broad and permit us to invest in any type of commercial real estate, including developed and undeveloped properties, entities owning these assets or other real estate assets regardless of geographic location or property type. Our CEO along with our Investment Committee has absolute discretion in implementing these policies and strategies, subject to the restrictions on investment objectives and policies set forth in our articles of incorporation. Because you cannot evaluate our investments, our securities

15

may entail more risk than other types of investments. This additional risk may hinder your ability to achieve your own personal investment objectives related to portfolio diversification, risk-adjusted investment returns and other objectives.

The loss of any of our executive officers could adversely affect our ability to continue operations.

We only have four full-time employees and are therefore entirely dependent on the efforts of our CEO and core staff. The departure of any of these employees and our inability to find suitable replacements, or the loss of other key personnel in the future, could have a harmful effect on our business.

Our President, Chief Executive Officer, and Chairman of the Board has guaranteed certain of our indebtedness, which could constitute a conflict of interest.

Our CEO has guaranteed promissory notes for certain of our property acquisitions. As a guarantor, Mr. Sobelman’s interests with respect to the debt he is guaranteeing (and the terms of any repayment or default) may not align with the Company’s interests and could result in a conflict of interest.

We rely on information technology networks and systems in conducting our business, and any material failure, inadequacy, interruption or security failure of that technology could harm our business.

We rely on information technology networks and systems, including the Internet, to process, transmit and store electronic information and to manage or support a variety of our business processes, including financial transactions and maintenance of records, which may include confidential information of tenants, lease data and information regarding our stockholders. We rely on commercially available systems, software, tools and monitoring to provide security for processing, transmitting and storing confidential information. Security breaches, including physical or electronic break-ins, computer viruses, attacks by hackers and similar breaches or cyber-attacks, can create system disruptions, shutdowns or unauthorized disclosure of confidential information. In addition, any breach in the data security measures employed by any third-party vendors upon which we may rely, could also result in the improper disclosure of personally identifiable information. Any failure to maintain proper function, security and availability of information systems could interrupt our operations, damage our reputation, subject us to liability claims or regulatory penalties and could materially and adversely affect us.

We have paid and may continue to pay distributions from offering proceeds to the extent our cash flow from operations or earnings are not sufficient to fund declared distributions. Rates of distribution to you will not necessarily be indicative of our operating results. If we make distributions from sources other than our cash flows from operations or earnings, we will have fewer funds available for the acquisition of properties and your overall return may be reduced.

Our organizational documents permit us to make distributions from any source, including the proceeds from an offering of our securities. To date, we have funded and expect to continue to fund distributions from the net proceeds of our offerings. We may also fund distributions with borrowings and the sale of assets to the extent distributions exceed our earnings or cash flows from operations. While we intend to pay distributions from cash flow from operations, our distributions paid to date were all funded by proceeds from our securities offerings. To the extent we fund distributions from sources other than cash flow from operations, such distributions may constitute a return of capital and we will have fewer funds available for the acquisition of properties and your overall return may be reduced. Further, to the extent distributions exceed our earnings and profits, a stockholder’s basis in our stock will be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder will be required to recognize capital gain.

Our structure may result in potential conflicts of interest with limited partners in our Operating Partnership whose interests may not be aligned with those of our stockholders.

Our directors and officers have duties to our corporation and our stockholders under Maryland law and our charter in connection with their management of the corporation. At the same time, we, as general partner, will have fiduciary duties under Delaware law to our Operating Partnership and to the limited partners in connection with the management of our Operating Partnership. Our duties as general partner of our Operating Partnership and its partners may come into conflict with the duties of our directors and officers to our corporation and our stockholders. Under Delaware law, a general partner of a Delaware limited partnership owes its limited partners the duties of good faith and fair dealing. Other duties, including fiduciary duties, may be modified or eliminated in the partnership’s partnership agreement. The partnership agreement of our Operating Partnership provides that, for so long as we own a controlling interest in our Operating Partnership, any conflict that cannot be resolved in a manner not adverse to either our stockholders or the limited partners will be resolved in favor of our stockholders.

Additionally, the partnership agreement expressly limits our liability by providing that we will not be liable or accountable to our Operating Partnership for losses sustained, liabilities incurred or benefits not derived if we acted in good faith. In addition, our Operating Partnership is required to indemnify us and our officers, directors, employees, agents and designees to the extent permitted by applicable law from and against any and all claims arising from operations of our Operating Partnership, unless it is established that: (1) the act or omission was material to the matter giving rise to the proceeding and either was committed in bad faith or was the result of active and deliberate dishonesty; (2) the indemnified party received an improper personal benefit in money, property or services; or (3) in the case of a criminal proceeding, the indemnified person had reasonable cause to believe that the act or omission was unlawful.

The provisions of Delaware law that allow the fiduciary duties of a general partner to be modified by a partnership agreement have not been tested in a court of law, and we have not obtained an opinion of counsel covering the provisions set forth in the partnership agreement that purport to waive or restrict our fiduciary duties.

16

Pandemics or other health crises, such as the COVID-19 pandemic, may adversely affect our tenants' financial condition, the profitability of our properties, and our access to the capital markets and could have a material adverse effect on our business, results of operations, cash flows and financial condition.

In response to the COVID-19 pandemic, federal, state, and local governments mandated or recommended various actions to reduce or prevent the spread of COVID-19, which altered customer behaviors and temporarily limited some of our tenants’ ability to operate. Although our tenants did not requested rent concessions or seek to renegotiate future rents based on changes to the economic environment during the COVID-19 pandemic, should federal, state, and local governments mandate or recommend lockdowns again in the future due to a pandemic or other similar health crises, tenants could request rent concessions or seek to renegotiate future rents.

In the event of future pandemics or similar health crises, consumers could elect to make more of their purchases online instead of in physical stores and businesses could delay executing new or renewals of leases amidst the immediate and uncertain economic impacts. These developments, coupled with potential tenant failures and a reduction in newly-formed businesses, could result in decreased demand for rental space, which could result in lower occupancy or higher levels of uncollectible lease income, as well as downward pressure on rents. Additionally, delays in construction of tenant improvements due to the impacts of constraints on supply chains and labor, resulting from government ordered lockdowns, could result in delayed rent commencement due to it taking longer for new tenants to open and operate.

Although the vast majority of our lease income is derived from contractual rent payments, the ability of certain of our tenants to meet their lease obligations could be negatively impacted by the disruptions and uncertainties of a new virus strain of COVID-19 or any future pandemic or other health crisis. Our tenants' ability to respond to these disruptions and uncertainties, including adjusting to governmental orders and changes in their customers' shopping habits and behaviors, may impact their ability to survive, and ultimately, their ability to comply with their lease obligations. Our future results of operations and overall financial performance could be uncertain should a new virus strain of COVID-19, or future pandemics or other health crises occur.

General Risks Related to Investments in Real Estate

The third party valuations of real estate investments we seek to purchase often times includes the value of a commercial lease and the loss of such a lease could result in the value of the real property declining.

Many of the properties that we seek to acquire include a commercial lease arrangement on the property and the corresponding purchase price for such property includes an assumption that such lease will continue. If we purchase a property with a commercial lease arrangement that terminates, the value of the investment may decline and we may be unable to sell the property for what we paid.

Our operating results will be affected by economic and regulatory changes that have an adverse impact on the real estate market in general, and we cannot assure you that we will be profitable or that we will realize growth in the value of our real estate properties.

Our operating results are subject to risks generally incident to the ownership of real estate, including:

17

If any of these or similar events occur, it may reduce our return from an affected property or investment and reduce or eliminate our ability to make distributions to stockholders.

If a major tenant declares bankruptcy, we may be unable to collect balances due under its leases, which would have a harmful effect on our financial condition and ability to pay distributions to you.

Our success will depend on the financial ability of our tenants to remain current with their leases with us. We may experience concentration in one or more tenants if the future leases we have with those tenants represent a significant percentage of our operations. As of March 29, 2024, we have five tenants, that each account for more than 10% of our annualized rent: the General Service Administration, Dollar General, the City of San Antonio, exp U. S. Services Inc., Kohl's Corporation who collectively contributed approximately 64% of our portfolio’s annualized base rent. Any of our current or future tenants, or any guarantor of one of our current or future tenant’s lease obligations, could be subject to a bankruptcy proceeding pursuant to Title 11 of the bankruptcy laws of the United States. Such a bankruptcy filing would bar us from attempting to collect pre-bankruptcy debts from the bankrupt tenant or its properties unless we receive an enabling order from the bankruptcy court. Post-bankruptcy debts would be paid currently. If we assume a lease, all pre-bankruptcy balances owing under it must be paid in full. If a lease is rejected by a tenant in bankruptcy, we would have a general unsecured claim for damages. This claim could be paid only in the event funds were available, and then only in the same percentage as that realized on other unsecured claims.

The bankruptcy of a current or future tenant or lease guarantor could delay our efforts to collect past due balances under the relevant lease, and could ultimately preclude full collection of these sums. Such an event also could cause a decrease or cessation of current rental payments, reducing our operating cash flows and the amount available for distributions to you. In the event a current or future tenant or lease guarantor declares bankruptcy, the tenant or its director may not assume our lease or its guaranty. If a given lease or guaranty is not assumed, our operating cash flows and the amounts available for distributions to you may be adversely affected. The bankruptcy of a major tenant would have a harmful effect on our ability to pay distributions to you.

A high concentration of our properties in a particular geographic area, or with tenants in a similar industry, magnify the effects of downturns in that geographic area or industry.

We plan to focus our acquisition efforts on markets where our tenants or potential tenants can be successful in their current and future operations. As of March 29, 2024, we own twenty-six properties, which are located in Alabama (1 property), Arizona (1 property), California (3 properties), Colorado (1 property), Washington, D.C. (1 property), Florida (5 properties), Georgia (1 property), Illinois (2 properties), Maine (2 properties), North Carolina (1 property), Ohio (3 properties), Pennsylvania (1 property), Texas (2 properties) and Virginia (2 properties). In the event that we have a concentration of properties in any particular geographic area, any adverse situation that disproportionately affects that geographic area, such as a local economic downturn or a severe natural disaster, would have a magnified adverse effect on our portfolio. In addition, we may own properties, either currently or in the future, that subjects us to the risk of rising sea levels, potential flooding, increased frequency or severity of hurricanes or other natural disasters as a result of climate change and global warming, which risk is increased given our geographic concentration. Similarly, if tenants of our properties become concentrated in a certain industry or industries or in any particular tenant, any adverse effect to that industry or tenant generally would have a disproportionately adverse effect on our portfolio.

We own twenty-three of our properties through preferred equity partnerships, which may lead to disagreements with our partners and adversely affect our interest in the partnerships.

As of March 29, 2024, we own twenty-three properties through preferred equity partnerships and we may enter into more in the future. Our partners, as well as any future partners, may have interests that are different from ours which may result in conflicting views as to the conduct of the business of the partnership. In the event that we have a disagreement with a partner as to the resolution of a particular issue to come before the partnership, or as to the management or conduct of the business of the partnership in general, we may not be able to resolve such disagreement in our favor and such disagreement could have a material adverse effect on our interest in the partnership.

In addition, investments made in partnerships or other co-ownership arrangements involve risks not otherwise present in investments we make, including the following risks:

Any of the risks above might subject us to liabilities and thus reduce our returns on our investment with that partner.

18

If a sale-leaseback transaction is re-characterized in a tenant’s bankruptcy proceeding, our financial condition could be adversely affected.

We may enter into sale-leaseback transactions, whereby we would purchase a property and then lease the same property back to the person from whom we purchased it. In the event of the bankruptcy of a tenant, a transaction structured as a sale-leaseback may be re-characterized as either a financing or a preferred equity partnership (which is generally classified as Redeemable Non-Controlling Interest or Non-Redeemable Non-Controlling Interest in our Operating Partnership), either of which outcomes could adversely affect our business. If the sale-leaseback were re-characterized as a financing, we might not be considered the owner of the property, and as a result would have the status of a creditor in relation to the tenant. In that event, we would no longer have the right to sell or encumber our ownership interest in the property. Instead, we would have a claim against the tenant for the amounts owed under the lease, with the claim arguably secured by the property. The tenant/debtor might have the ability to propose a plan restructuring the term, interest rate and amortization schedule of its outstanding balance. If confirmed by the bankruptcy court, we could be bound by the new terms, and prevented from foreclosing our lien on the property. If the sale-leaseback were re-characterized as a joint venture, our lessee and we could be treated as co-venturers with regard to the property. As a result, we could be held liable, under some circumstances, for debts incurred by the lessee relating to the property. Either of these outcomes could adversely affect our cash flow and the amount available for distributions to you.

We may obtain only limited warranties when we purchase a property and would have only limited recourse in the event our due diligence did not identify any issues that lower the value of our property.

The seller of a property often sells such property in its “as is” condition on a “where is” basis and “with all faults,” without any warranties of merchantability or fitness for a particular use or purpose. In addition, purchase agreements may contain only limited warranties, representations and indemnifications that will only survive for a limited period after the closing. Thus, the purchase of properties with limited warranties increases the risk that we may lose some or all of our invested capital in the property as well as the loss of rental income from that property.

Our real estate investments may include special use single-tenant properties that may be difficult to sell or re-lease upon lease terminations.

We have invested and intend to invest primarily in single-tenant, income-producing commercial retail, medical, office and industrial properties, a number of which may include special use single-tenant properties. If the leases on these properties are terminated or not renewed, we may have difficulty re-leasing or selling these properties to new tenants due to the lack of efficient alternate uses for such properties. Therefore, we may be required to expend substantial funds to renovate and/or adapt any such property for a revenue-generating alternate use or make rent concessions in order to lease the property to another tenant or sell the property. These and other limitations may adversely affect the cash flows from, lead to a decline in value of or eliminate the return on investment of, these special use single-tenant properties.

We may be unable to secure funds for future tenant improvements, build outs or capital needs, which could adversely impact our ability to pay cash distributions to our stockholders.

When tenants do not renew their leases or otherwise vacate their space, it is usual that, in order to attract replacement tenants, we will be required to expend substantial funds for tenant improvements, tenant refurbishments or tenant-specific build outs to the vacated space. In addition, although we expect that our leases with tenants will require tenants to pay routine property maintenance costs, we will likely be responsible for any major structural repairs, such as repairs to the foundation, exterior walls and rooftops. If we need additional capital in the future to improve or maintain our properties or for any other reason, we will have to obtain financing from cash flow from operations, borrowings, property sales or future equity offerings. These sources of funding may not be available on attractive terms or at all. If we cannot procure additional funding for capital improvements, our investments may generate lower cash flows or decline in value, or both.

Our inability to sell a property when we desire to do so could adversely impact our ability to pay cash distributions to you.

The real estate market is affected by many factors, such as general economic conditions, availability of financing, interest rates, supply and demand, and other factors that are beyond our control. We cannot predict whether we will be able to sell any property for the price or on the terms set by us, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We may be required to expend funds to correct defects or to make improvements before a property can be sold. We may not have adequate funds available to correct such defects or to make such improvements. Moreover, in acquiring a property, we may agree to restrictions that prohibit the sale of that property for a period of time or impose other restrictions, such as a limitation on the amount of debt that can be placed or repaid on that property. We cannot predict the length of time needed to find a willing purchaser and to close the sale of a property. Our inability to sell a property when we desire to do so may cause us to reduce our selling price for the property, and could adversely impact our ability to pay distributions to you. Furthermore, our ability to dispose of certain of our properties is subject to certain limitations imposed by our tax protection agreements.

We may not be able to sell our properties at a price equal to, or greater than, the price for which we purchased such property, which may lead to a decrease in the value of our assets.

Some of our leases may not contain rental increases over time, or the rental increases may be less than the fair market rate at a future point in time. In such event, the value of the leased property to a potential purchaser may not increase over time, which may restrict our ability to sell that property, or if we are able to sell that property, may result in a sale price less than the price that we paid to purchase the property.

19

We may acquire or finance properties with lock-out provisions, which may prohibit us from selling a property, or may require us to maintain specified debt levels for a period of years on some properties.