UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

GENERATION INCOME PROPERTIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

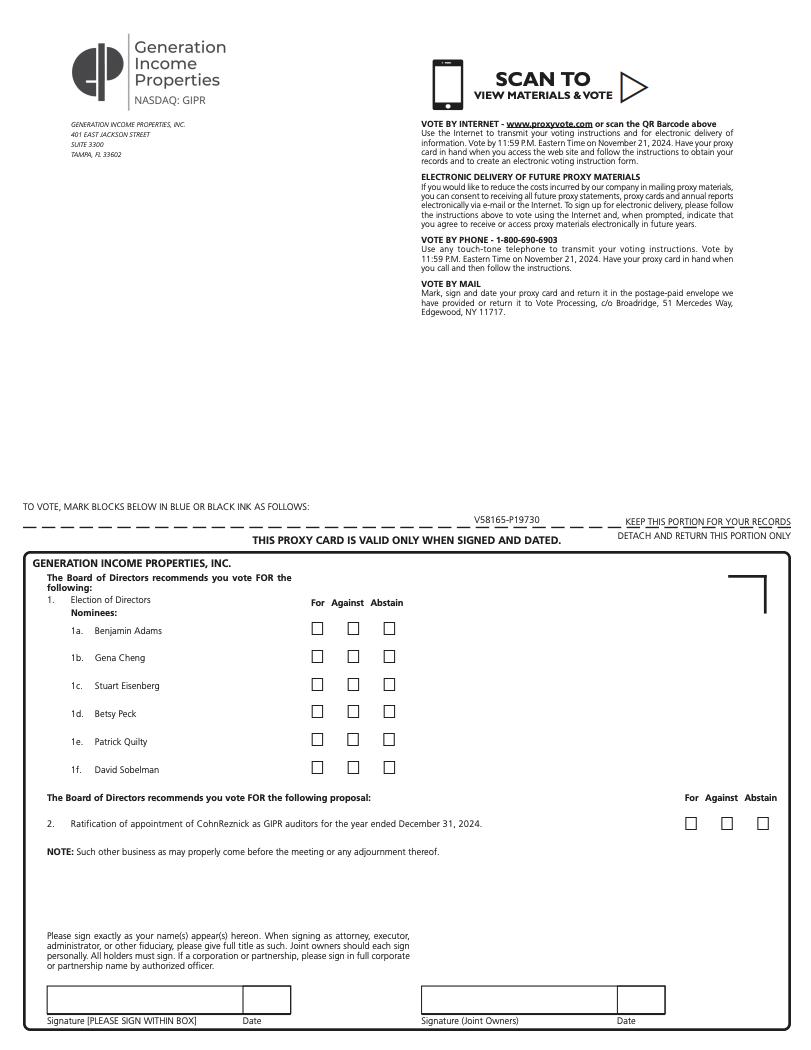

NOTICE OF 2024 ANNUAL MEETING

AND PROXY STATEMENT

October 16, 2024

You are cordially invited to attend our 2024 Annual Meeting of Stockholders, which will be held at 100 North Tampa Street, Suite 2700, Tampa, Florida 33602, on Friday, November 22, 2024, at 10:00 a.m., local time. Stockholders will be admitted beginning at 9:45 a.m.

The attached notice of Annual Meeting of Stockholders and proxy statement cover the formal business of the Annual Meeting and contain a discussion of the matters to be voted upon at the Annual Meeting. At the Annual Meeting, our management will also provide a report on our operations and achievements during the past year.

Your vote is very important. Whether or not you plan to attend the meeting in person, please vote your shares by completing, signing and returning the accompanying proxy card, or by following the instructions on the card for voting by telephone or internet. If you later decide to attend the Annual Meeting and vote in person, you may revoke your proxy at that time.

David Sobelman

|

|

Chairman of the Board Chief Executive Officer |

1

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF GENERATION INCOME PROPERTIES, INC.

TIME: |

10:00 a.m., local time, on Friday, November 22, 2024. Stockholders will be admitted beginning at 9:45 a.m. |

|

|

|

|

PLACE: |

Foley & Lardner LLP Gasparilla Conference Room 100 North Tampa Street, Suite 2700 Tampa, Florida 33602

|

|

ITEMS OF BUSINESS: |

1. |

To elect six (6) directors to hold office for a one-year term ending at the 2025 annual meeting of stockholders and until his or her successor is duly elected and qualifies, or until his or her death, resignation, retirement or removal (whichever occurs first). |

|

|

|

|

2. |

To ratify the appointment of CohnReznick LLP as the Company’s independent registered public accounting firm for fiscal year 2024.

|

|

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

|

|

RECORD DATE |

Stockholders of record on October 11, 2024, are entitled to notice of the Annual Meeting and are entitled to vote at the Annual Meeting in person or by proxy. |

|

|

|

|

ANNUAL REPORT |

Our 2023 Annual Report to Stockholders, which is not a part of this proxy statement, is enclosed. |

|

|

|

|

PROXY VOTING

|

It is important that your shares be represented at the Annual Meeting and voted in accordance with your instructions. Please indicate your instructions by promptly signing and dating the enclosed proxy card and mailing it in the enclosed postage paid, pre-addressed envelope or by following the instructions on the proxy card for telephone or internet voting. |

|

By Order of the Board of Directors,

David Sobelman

Chairman of the Board

Chief Executive Officer

2

PROXY STATEMENT

2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 22, 2024

TO THE STOCKHOLDERS OF GENERATION INCOME PROPERTIES, INC.: |

|

October 16, 2024 |

This proxy statement and the form of proxy are delivered in connection with the solicitation by the Board of Directors of Generation Income Properties Inc. (the “Company,” “we,” “us,” or “our”), a Maryland corporation, of proxies to be voted at our 2024 Annual Meeting of Stockholders and at any adjournments or postponements thereof.

You are invited to attend our 2024 Annual Meeting of Stockholders on Friday, November 22, 2024, beginning at 10:00 a.m.. The Annual Meeting will be held at 100 North Tampa Street, Suite 2700, Tampa, Florida 33602. Stockholders will be admitted beginning at 9:45 a.m.

Your vote is very important. Therefore, whether you plan to attend the Annual Meeting or not and regardless of the number of shares you own, please date, sign and return the enclosed proxy card promptly or follow the instructions on the card for voting by telephone or internet.

At the meeting, the use of cameras, audio or video recording equipment, communications devices or similar equipment will be prohibited.

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be Held on November 22, 2024:

This proxy statement and the 2023 Annual Report to Stockholders are available at www.proxyvote.com.

Upon your written request, we will provide you with a copy of our 2023 annual report on Form 10-K, including exhibits, free of charge. Send your request to Generation Income Properties, Inc., Attention: David Sobelman, Chief Executive Officer, 401 East Jackson St, Suite 3300, Tampa, Florida 33602, ir@gipreit.com, 813-448-1234.

We will begin mailing this proxy statement to our Shareholders on or about October 17, 2024.

ABOUT THE ANNUAL MEETING

What is the purpose of the meeting?

The principal purposes of the Annual Meeting are the election of six directors to serve on the Company’s Board of Directors for an additional one-year term and to ratify the appointment of our independent registered public accounting firm for fiscal year 2024.

When were these materials mailed?

We will begin mailing this proxy statement to our shareholders on or about October 17, 2024.

Who is entitled to vote?

3

Stockholders of record at the close of business on the record date, October 11, 2023, will receive notice of, and be eligible to vote at, the Annual Meeting and at any adjournment or postponement of the Annual Meeting. At the close of business on the record date our only outstanding class of voting securities was common stock, $0.01 par value per share, and there were 5,423,188 common shares outstanding and entitled to vote.

How many votes do I have?

Each outstanding share of our common stock you owned as of the record date will be entitled to one vote for each matter considered at the meeting. There is no cumulative voting.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of stockholders entitled to cast a majority of the votes will constitute a quorum, permitting us to conduct the business of the meeting. Proxies received but marked as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered to be present at the meeting for purposes of a quorum.

What is the difference between a stockholder of record and a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are a “stockholder of record.” This Notice of Meeting and proxy statement has been provided directly to you by Generation Income Properties, Inc. You may vote by ballot at the meeting or vote by proxy. To vote by proxy, sign, date and return the enclosed proxy card or follow the instructions on the proxy card for voting by telephone or internet.

If your shares are held for you in a brokerage, bank or other institutional account (that is, held in “street name”), then you are not a stockholder of record. Rather, the institution is the stockholder of record and you are the “beneficial owner” of the shares. The accompanying Notice of Meeting and this proxy statement have been forwarded to you by that institution. If you complete and properly sign the accompanying proxy card and return it in the enclosed envelope or follow the instructions on the proxy card for voting by telephone or internet, the institution will cause your shares to be voted in accordance with your instructions. If you are a beneficial owner of shares and wish to vote in person at the Annual Meeting, then you must obtain a proxy, executed in your favor, from the holder of record (the institution).

How do I vote if I am a stockholder of record?

By Ballot at the Meeting. If you are a stockholder of record and attend the Annual Meeting, you may vote in person by ballot at the Annual Meeting. To vote by ballot, you must register and confirm your stockholder status at the meeting. If the stockholder of record is a corporation, partnership, limited liability company or other entity of which you are an officer or other authorized person, then you should bring evidence of your authority to vote the shares on behalf of the entity.

By Proxy Card. If you complete, sign and return the accompanying proxy card or follow the instructions on the proxy card for voting by telephone or internet, then your shares will be voted as you direct. If you are a stockholder of record, then you may opt to deliver your completed proxy card in person at the Annual Meeting.

Voting by Telephone or Internet. If you are a stockholder of record, you may vote by proxy by telephone or internet. Proxies submitted by telephone or through the internet must be received by 11:59 p.m. EDT on November 21, 2024. Please see the proxy card for instructions on how to vote by telephone or internet.

How do I vote if I hold my shares in “street name”?

If you hold your shares in “street name,” we have supplied copies of our proxy materials for the 2024 Annual Meeting of Stockholders to the broker, trust, bank or other nominee holding your shares of record and they have the responsibility to send these proxy materials to you. You must either direct the broker, trust, bank or other nominee as to how to vote your shares, or obtain a proxy

4

from the bank, broker or other nominee to vote at the meeting. Please refer to the voter instruction cards used by your broker, trust, bank or other nominee for specific instructions on methods of voting, including by telephone or using the internet.

What Vote is Required to Approve each Item?

For Proposal 1, election of directors, you may vote “FOR,” “AGAINST” or “ABSTAIN” with respect to each of the nominees. Our bylaws provide that in an uncontested election, each nominee will be elected as a director if he or she receives the affirmative vote of a majority of the total votes cast “FOR” and “AGAINST” with respect to his or her election as a director at the Annual Meeting. Any abstentions or broker non-votes are not counted as votes cast either “FOR” or “AGAINST” with respect to a director’s election and will have no effect on the election of directors.

For Proposal 2, the ratification of the appointment of CohnReznick LLP as our independent registered public accounting firm for fiscal year 2024, you may vote “FOR,” “AGAINST” or “ABSTAIN” with respect to the ratification of the appointment of CohnReznick LLP as our independent registered public accounting firm for fiscal year 2024. Ratification of the appointment of our independent registered public accounting firm for fiscal year 2024 requires a majority of the votes cast on the proposal at the Annual Meeting to be voted “FOR” this proposal. Abstentions will not count as votes cast either “FOR” or “AGAINST” Proposal No. 2 and will have no effect on the results of the vote on this proposal. Discretionary voting is permitted on this proposal, and, therefore, we do not anticipate any broker non-votes for this proposal.

What does it mean if I receive more than one proxy card?

You will receive separate proxy cards when you own shares in different ways. For example, you may own shares individually, as a joint tenant, in an individual retirement account, in trust or in one or more brokerage accounts. You should complete, sign and return each proxy card you receive or follow the telephone or internet instructions on each card. The instructions on each proxy card may differ. Be sure to follow the instructions on each card.

Can I change my vote or instruction?

Yes. You may follow the instructions on the proxy card to change your votes or instructions any time before midnight the day before the meeting. In addition, if you are a stockholder of record, you may revoke your proxy any time before your shares are voted by filing with the secretary of the Company a written notice of revocation or submitting a duly executed proxy bearing a later date. If you file a notice of revocation, you may then vote (or abstain from voting) your shares in person at the Annual Meeting. If you submit a later dated proxy, then your shares will be voted in accordance with that later dated proxy. No such notice of revocation or later dated proxy, however, will be effective unless received by us at or before the Annual Meeting and before your shares have been voted. Unless the proxy is revoked, the shares represented thereby will be voted at the Annual Meeting or any adjournment thereof as indicated on the proxy card. Sending in a proxy does not affect your right to vote in person if you attend the meeting, although attendance at the meeting will not by itself revoke a previously granted proxy.

If I submit a proxy card, how will my shares be voted?

Your shares will be voted as you instruct on the proxy card.

What happens if I submit a proxy card and do not give specific voting instructions?

If you are a stockholder of record and sign and return the proxy card without indicating your instructions, your shares will be voted in accordance with the recommendations of the Board of Directors by the proxies named on such card. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, at their own discretion. As of the date this proxy statement went to print, we did not know of any other matters to be raised at the Annual Meeting.

5

What are the Board of Directors’ recommendations?

The Board of Directors recommends stockholders vote:

|

➢ |

FOR election of the six director nominees named below to serve on the Company’s Board of Directors for an additional one-year term until the next annual meeting of stockholders and until his or her successor is duly elected and qualified, or until his or her death, resignation, retirement or removal (whichever occurs first): |

Benjamin Adams

Gena Cheng

Stuart Eisenberg

Betsy Peck

Patrick Quilty

David Sobelman

|

➢ |

FOR the proposal to ratify the appointment of CohnReznick LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024. |

How will votes be counted?

All votes will be tabulated by the secretary of the Company. We have engaged Broadridge Financial Solutions, Inc. to collect and tabulate proxy instructions.

Who is paying for the preparation and mailing of the proxy materials and how will solicitations be made?

We will pay the expenses of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by mail, telephone, facsimile or electronic transmission. We have requested brokerage houses and other custodians, nominees and fiduciaries to forward soliciting material to beneficial owners and have agreed to reimburse those institutions for their out-of-pocket expenses.

6

PROPOSAL 1

ELECTION OF DIRECTORS

As of the date of this proxy statement, our Board has six directors. All current directors have been nominated to stand for re-election at the 2024 Annual Meeting. The Board will consist of six directors after the 2024 Annual Meeting assuming the election of all director nominees. All current directors elected at the meeting will serve until the 2025 annual meeting and until his or her successor is duly elected and qualified, or until his or her death, resignation, retirement or removal (whichever occurs first). The accompanying proxy will be voted FOR the election of each of the Board’s nominees unless a stockholder directs otherwise. Each nominee is presently available for election. If any nominee should become unavailable, which is not currently anticipated, the persons voting the accompanying proxy may vote for a substitute nominee designated by our Board of Directors or our Board may reduce the size of the Board and number of nominees.

With the recommendation of the nominating and governance committee, the Board of Directors has nominated the following persons to stand for re-election as directors at this 2024 Annual Meeting of Stockholders:

Benjamin Adams

Gena Cheng

Stuart Eisenberg

Betsy Peck

Patrick Quilty

David Sobelman

Each of the nominees for re-election as a director has consented to serve if elected. If, as a result of circumstances not now known or foreseen, one or more of the nominees should be unavailable or unwilling to serve as a director, proxies may be voted for the election of such other persons as the Board of Directors may select. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve. Information about each of the nominees, including biographies, is set forth below and on the following pages.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

7

DIRECTORS

Set forth below is a summary of the background and experience of each director nominee. There is no family relationship between director nominee or executive officer of the Company.

Directors Standing for Re-Election

Benjamin Adams, age 52, has been a board member since July 2019. He has also been Chief Executive Officer and Founder of Ten Capital Management since May 2011, an independent, fundamental value-driven private equity real estate firm based in Cleveland, Ohio. He is responsible for the strategic direction and oversight of all firm activities. From January 2008 to April 2011, Mr. Adams was a Portfolio Manager with The Townsend Group, where he oversaw $1.7 billion in private equity real estate assets under management within the firm’s discretionary investment management business and was actively involved in product development and structuring. Prior to Townsend, Mr. Adams was a Vice President and General Counsel of Lionstone Development LLC, a Miami-based, principal balance sheet investor.

Mr. Adams practiced law with Greenberg Traurig LLP in New York, New York, and served as the Special Assistant to the White House Counsel in the Clinton Administration. Mr. Adams has a law degree from Georgetown University Law Center and a Bachelor of Arts from Miami University in Oxford, Ohio. We believe that Mr. Adam’s position as the founder and Chairman Emeritus of the Defined Contribution Real Estate Council (DCREC) and his understanding of accounting principles and financial presentation and analysis qualifies him for service as one of our directors.

Gena Cheng, age 53, was appointed a board member on October 5, 2021. She has been managing director since August 2019 at Prospect Avenue Partners, a specialty capital raising, and advisory platform focused on the private equity industry. Named to PERE’s list of 30 Capital Raisers Who Can Make a Difference, Ms. Cheng has over 20 years of experience in the real asset industry, including investments, portfolio management, fundraising and investor relations. Ms. Cheng brings valuable real estate finance experience to the Company’s Board of Directors. Prior to launching Prospect Avenue Partners, Ms. Cheng served as Managing Director from July 2014 to February 2019 at USAA Real Estate Company. She also served as Managing Director from March 2010 to March 2014 at Forum Partners, a global real estate investment and asset management firm, and Managing Director and Chief Operating Officer from October 2006 to August 2009 at JT Partners, an international architecture, engineering, projects management, and consulting firm.

Ms. Cheng has significant experience raising investor equity for strategies ranging from core through opportunistic via open-end and closed-end vehicles. Prior to her transition to the sell side, she served as a senior portfolio manager at APG Asset Management, the approximately €538 billion Dutch pension fund. There she helped invest and manage the capital of one of the largest institutional real estate investment platforms in the world, focusing on North American investments. Ms. Cheng began her career in real estate consulting and investment banking at Arthur Andersen and Morgan Stanley.

Ms. Cheng earned a JD/MBA from New York University and an AB in Architecture from Princeton University, where she was awarded the Grace May Tilton Prize in American Studies. She is a member of the New York State Bar and serves on the Program Committee and Scholarship Committee for WX – New York Women Executives in Real Estate. Ms. Cheng holds her FINRA registered representative license through SPS Securities, LLC. We believe that Ms. Cheng’s years of experience in the real asset industry, including investments, portfolio management, fundraising and investor relations, qualify her for service as one of our directors.

Stuart Eisenberg, age 62, was appointed a board member on February 3, 2020. He has been an independent consultant since June 2019 when he retired from BDO USA, LLP where he was a partner in the real estate services group from July 1997 until June 2019. Mr. Eisenberg served as the firm’s national real estate and construction industry practice leader and a member of the firm’s international real estate and construction industry steering committee. His experience includes consulting in connection with the formation, structuring and development of real estate investment trusts ("REIT") and real estate operating companies. He also provided financial reporting and due-diligence services in numerous initial and follow-on public offerings and in connection with the acquisition, financing and dispositions of commercial real estate.

Mr. Eisenberg has a bachelor’s degree from Adelphi University and is a member of the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants. Mr. Eisenberg’s experience serving publicly-held companies brings to our Board of Directors a comprehensive understanding of public company operations, financial reporting, and corporate governance, as well as perspective regarding potential acquisitions. We believe that Mr. Eisenberg’s prior work a partner at BDO USA, LLP in the real estate services group and sophisticated understanding of accounting principles, auditing standards, and internal accounting controls qualify him for service as one of our directors.

8

Betsy Peck, age 64, was appointed a board member on February 3, 2020. She retired in 2018 from Jones Lang LaSalle (“JLL”) a publicly held professional services firm specializing in real estate and investment management. Ms. Peck served in various positions from July 2008 to March 2018 with the latest position being Chief Operating Officer, Markets where she was responsible for managing a $2 billion operation with more than 1,000 sales professionals for maximum efficiency and effectiveness, driving ongoing growth. Prior to this role, Ms. Peck served as JLL’s Chief Administrative Officer, Brokerage from July 2008 to December 2012. Ms. Peck also served as Chief Administrative Officer at The Staubach Company where she worked from June 1996 to July 2008, she was a senior partner who drove strategy and execution for optimum integration of finance, human resources, IT and administration. She was also an integral member of the team during the company’s merger with Jones Lang LaSalle. Prior to that, Ms. Peck served in a variety of companies in various finance and accounting functions.

Ms. Peck obtained a Bachelor of Science in Accounting from the University of Scranton. She is a member of the American Institute of Certified Public Accountants. Ms. Peck also serves or has served as an advisory board member for several companies including Forge, Patrocinium and Truist. Ms. Peck’s experience serving publicly-held companies brings to our Board of Directors an understanding of public company operations, financial reporting, disclosure, and corporate governance. We believe that Ms. Peck’s prior real estate management experience and her understanding of accounting principles, internal accounting control and financial presentation and analysis qualify her for service as one of our directors.

Patrick Quilty, age 58, has been a board member since July 2019. He has also been Chief Credit Officer for a top global insurance company since September 2012. He is responsible for overseeing, assessing and approving a portfolio of highly structured transactions providing global risk solutions for middle market and Fortune 50 companies across diversified industries. From October 2010 to September 2012, Mr. Quilty was Co-Founder and Head of Credit Risk at Specialized Performance Advisory Group LLC, an independent asset management firm providing investment, advisory and risk counseling for family office and institutional clients. From November 2003 to October 2010, Mr. Quilty was a Senior Portfolio Manager for Barclays Capital Loan Portfolio focused on the Specialty Finance and REIT sectors. Mr. Quilty has also served as a credit derivatives trader in their Principal Credit and Risk Finance Group.

Over his thirty-year career, Mr. Quilty has held senior portfolio, trading and risk management positions at ABN AMRO, Chase Asset Management, Lehman Brothers and JP Morgan. Mr. Quilty has a Bachelor of Science in Economics from Florida State University and completed graduate coursework in Real Estate Investment and Development at the Steven L Newman Real Estate Institute at Baruch College. We believe that Mr. Quilty’s prior work experience and understanding of accounting principles, risk management, financial presentation and analysis qualify him for service as one of our directors.

David Sobelman, age 52, serves as chairman of our Board and our President, Chief Executive Officer, and Secretary. He founded Generation Income Properties, Inc. after serving almost 13 years in different capacities within the net lease commercial real estate market. In June 2017, Mr. Sobelman started 3 Properties, a commercial real estate brokerage firm focused solely on the net lease market. Mr. Sobelman has held various roles within the single tenant, net lease commercial real estate investment market, including investor, asset manager, broker, owner, analyst and advisor. In 2005, David began working with Calkain Companies LLC, a real estate brokerage and advisory firm. During his tenure, Calkain grew from two employees to over 40, and became one of the leading single tenant, net lease firms in the country. Prior to Mr. Sobelman’s career in single tenant, net lease investments, he served as a member of The White House staff, and was subsequently appointed to work for the Secretary of the Department of Health and Human Services. Mr. Sobelman wrote The Little Book of Triple Net Lease Investing, a leading book on the single tenant, triple-net lease investment market, which is currently in its second edition. Mr. Sobelman is a featured speaker at conferences in the United States and abroad and has been quoted in articles in The Wall Street Journal, Forbes, Fortune and various regional real estate trade publications. Mr. Sobelman received a Bachelor of Science degree from the University of Florida and is an alumnus of the Harvard Business School Executive Education Real Estate Management Program. Mr. Sobelman is a board member for the University of Florida Foundation. We believe that Mr. Sobelman’s experience in the net lease commercial real estate market and his status as founder of the Company qualify him for service as one of our directors.

9

Director Nominees

The Board of Directors believes that it is necessary for its members to possess qualities, attributes and skills that contribute to a diverse range of views and perspectives among the directors and enhance the overall effectiveness of the Board. Our Nominating and Governance Committee considers all factors it deems relevant when evaluating prospective candidates or current board members for nomination to the Board of Directors. The Board is comprised of highly qualified individuals with unique and special skills that assist in effective management of the Company for the benefit of our stockholders.

Each of our directors possesses certain experience, qualifications, attributes and skills, as further described above, that led to our conclusion that he or she should serve as a member of the Board. In addition to the foregoing biographical information with respect to each of our directors, the following tables evidences additional diversity, experience and qualifications of our individual directors.

Board Diversity Matrix (as of October 11, 2024) |

||||

Total Number of Directors |

6 |

|||

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

Part I: Gender Identity |

||||

Directors |

2 |

3 |

|

1 |

Part II: Demographic Background |

||||

African American or Black |

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

Asian |

1 |

|

|

|

Hispanic or Latinx |

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

White |

1 |

3 |

|

|

Two or More Races or Ethnicities |

|

|

|

|

LGBTQ |

|

|||

Did Not Disclose Demographic Background |

1 |

|||

Director Independence

The Nasdaq Marketplace Rules require a majority of a listed company’s Board of Directors to be comprised of independent directors. In addition, the Nasdaq Marketplace Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act.

Under Rule 5605(a)(2) of the Nasdaq Marketplace Rules, a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3 of the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the Board of Directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries.

Our Board of Directors has reviewed the composition of our Board of Directors and its committees and the independence of each director. Based upon information requested from and provided by each director concerning their background, employment and affiliations, including family relationships, our Board of Directors has determined that each of Benjamin Adams, Gena Cheng, Patrick Quilty, Betsy Peck and Stuart Eisenberg is an “independent director” as defined under Rule 5605(a)(2) of the Nasdaq Marketplace Rules. Our Board of Directors also determined that the directors who each serve on our audit committee, our compensation committee, and our nominating and corporate

10

governance committee, satisfy the independence standards for such committees established by the SEC and the Nasdaq Marketplace Rules, as applicable. In making such determinations, our Board of Directors considered the relationships that each such non-employee director has with the Company and all other facts and circumstances our Board of Directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

Director Compensation

The pro-rated vested share restrictions are removed upon the annual anniversary of the award.

We do not have any other agreements for compensating our directors for their services in their capacity as directors, although such current and future directors are expected in the future to receive restricted shares or stock options to purchase shares of our common stock as awarded by our Board with the exception of Mr. Sobelman, who receives no additional compensation for his service as a director. None of our directors has ever been paid any cash compensation. The following table summarizes all of the compensation earned by our directors for service as a director of the Company during the year ended December 31, 2023:

Name |

|

Fiscal Year |

|

Fees Earned or Paid in Cash |

|

|

Stock Awards (1) |

|

|

Total |

|

|||

Benjamin Adams |

|

2023 |

|

|

- |

|

|

|

$50,000 |

|

|

|

$50,000 |

|

Gena Cheng |

|

2023 |

|

|

- |

|

|

|

$50,000 |

|

|

|

$50,000 |

|

Stuart Eisenberg |

|

2023 |

|

|

- |

|

|

|

$50,000 |

|

|

|

$50,000 |

|

Betsy Peck |

|

2023 |

|

|

- |

|

|

|

$50,000 |

|

|

|

$50,000 |

|

Patrick Quilty |

|

2023 |

|

|

- |

|

|

|

$50,000 |

|

|

|

$50,000 |

|

(1) The amounts reported in this column represent the aggregate fair value of the stock awards, calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Stock Compensation. Relevant assumptions used to determine these amounts include a $5.68 per share valuation with a 0% forfeiture rate.

11

TRANSACTIONS WITH RELATED PERSONS

Securities and Exchange Commission ("SEC") rules require us to disclose any transaction or currently proposed transaction in which we are a participant and in which any related person has or will have a direct or indirect material interest involving an amount that exceeds the lesser of $120,000 or one percent (1%) of the average of the Company’s total assets as of the end of the last two completed fiscal years. A related person is any executive officer, director, nominee for director, or holder of 5% or more of the Company’s common stock, or an immediate family member of any of those persons.

We have a formal written policy for the review and approval of transactions with related parties. Our policy with regard to transactions with related persons is that all material transactions are to be reviewed by the entire Board for any possible conflicts of interest. The Board is responsible for review, approval, or ratification of “related-person transactions” involving the Company and related persons.

On October 14, 2022, we entered into a loan transaction that is evidenced by a secured non-convertible promissory note to Brown Family Enterprises, LLC, a preferred equity member of one of the Company's operating subsidiaries and therefore a related party, for $1.5 million that is due on October 14, 2024, and bears a fixed interest rate of 9%, simple interest. Interest is payable monthly. The loan may be repaid without penalty at any time. The loan is secured by the Operating Partnership’s equity interest in its current direct subsidiaries that hold real estate assets pursuant to the terms of a security agreement between the Operating Partnership and Brown Family Enterprises, LLC. On July 21, 2023, we amended and restated the loan and the related security agreement with Brown Family Enterprises, LLC to reflect an increase in the note and the loan evidenced thereby from $1.5 million to $5.5 million and to extend the maturity date thereof from October 14, 2024 to October 14, 2026. Except for the increase in the amount of the loan and note and the extension of the maturity date thereof, no changes were made to the original note and security agreement.

On August 9, 2022, we entered into a redemption agreement with Thomas E. Robinson, a unit holder in our Operating Partnership under which we agreed to redeem his units in our Operating Partnership under a set schedule. As such, we recorded an Other payable—related party in the amount of $2,912,300 upon execution of the redemption agreement and made the first, and second installment payments of $325,000 on September 13, 2022 and March 8, 2023 and a third installment payment of $452,460 on September 15, 2023 resulting in a remaining balance of $1,809,840 outstanding as of December 31, 2023. Additionally, the Company issued 200,000 shares of common stock at $6.00 per share in accordance with the redemption agreement, and recorded the stock at par value of $2,000 with the remaining $1,198,000 to Additional paid in capital.

On November 30, 2020, we acquired an approximately 3,500 square foot building from GIP Fund 1, LLC a related party that was owned 11% by the President and Chairman of the Company. The retail single tenant property occupied by The Sherwin-Williams Company in Tampa, Florida was acquired for approximately $1.8 million and was funded with approximately $1.3 million of debt from Valley National Bank and the issuance of 24,309 partnership units in the Operating Partnership valued at $20.00 per unit for purposes of the contribution. Since the acquisition, GIP Fund 1, LLC was dissolved and each partner was allocated units of the Operating Partnership pro-rata effectively reducing the President and Chairman of the Company’s ownership to 0.09% as of December 31, 2023.

During the twelve months ended December 31, 2023 and December 31, 2022, the Company incurred a guaranty expense to the Company's President and CEO of $290,316 and $128,901 of which $177,347 and $128,901 remained payable as of December 31, 2023 and 2022, respectively.

12

CORPORATE GOVERNANCE

Board Leadership Structure

Our business and affairs are managed under the direction of the Board of Directors. Under our current leadership structure, David Sobelman serves as Chairman of the Board of Directors, Chief Executive Officer and President. Mr. Sobelman’s role includes providing continuous feedback on the direction and performance of the Company, serving as chairman of regular meetings of the Board of Directors, setting the agenda for the meetings of the Board of Directors and leading the Board of Directors in anticipating and responding to changes in our business. Mr. Sobelman plays a significant role also in formulating and executing the Company’s strategic plans, financing activity and investment decisions. We believe board oversight and planning is a collaborative effort among the directors, each of whom has unique skills, experience and education, and this structure facilitates collaboration and communication among the directors and management and makes the best use of their respective skills. The Board of Directors periodically reviews the board leadership structure to evaluate whether the structure remains appropriate for the Company and may determine to alter this leadership structure anytime based on then existing circumstances.

Our Board does not have a policy on whether the same person should serve as both the President and Chairman of the Board or, if the roles are separate, whether the Chairman should be selected from the non-employee directors or should be an employee. Our Board believes that it should have the flexibility to periodically determine the leadership structure that it believes is best for the Company. The Board believes that its current leadership structure, with Mr. Sobelman serving as both President and Board Chairman, is appropriate given the efficiencies of having the President also serve in the role of Chairman. The Board currently believes that Mr. Sobelman is uniquely qualified to serve as President and in the role of leader of the Board given his history and experience with the Company, his significant ownership interest in the Company and the current size of the Company and the Board.

Our lead independent director is currently Benjamin Adams. The Chairman and the President consults periodically with the lead director on Board matters and on issues facing the Company. In addition, the lead director serves as the principal liaison between the Chairman of the Board and the independent directors and presides at an executive session of non-management directors at each regularly scheduled Board meeting.

Role of Board in Risk Oversight Process

We face a number of risks, including those described under the caption “Risk Factors” in our Annual Report on Form 10-K. Our Board of Directors believes that risk management is an important part of establishing, updating and executing on our business strategy. Our Board of Directors has oversight responsibility relating to risks that could affect our corporate strategy, business objectives, compliance, operations, and the financial condition and performance. Our Board of Directors focuses its oversight on the most significant risks facing us and, on our processes, to identify, prioritize, assess, manage and mitigate those risks. Our Board of Directors receives regular reports from members of our senior management on areas of material risk to us, including strategic, operational, financial, legal and regulatory risks. While our Board of Directors has an oversight role, management is principally tasked with direct responsibility for management and assessment of risks and the implementation of processes and controls to mitigate their effects on us.

Indemnification Agreements

We have entered into indemnification agreements with each of our executive officers and directors, and expect to enter into indemnification agreements with future executive officers and directors. Each indemnification agreement provides, among other things, that we will indemnify, to the maximum extent permitted by law, the covered officer or director against any and all judgments, penalties, fines and amounts paid in settlement, and all reasonable and out-of-pocket expenses (including attorneys’ fees), actually and reasonably incurred in connection with any threatened, pending or completed action, suit, arbitration, alternative dispute resolution mechanism, investigation, inquiry, administrative hearing or other proceeding that arises out of the officer’s or director’s status as a present or former officer, director, employee or agent of the Company. Each indemnification agreement also requires us, upon request of the covered officer or director, to advance the expenses related to such an action provided that the officer or director undertakes to repay any amounts to which he is subsequently determined not to be entitled. The indemnification agreement is not exclusive of any other rights to indemnification or advancement of expenses to which the covered officer or director may be entitled, including any rights arising under our charter or bylaws or applicable law.

13

Disclosure of Commission Position on Indemnification for Securities Act Liabilities.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is therefore unenforceable.

Board Committees

Our Board of Directors has established three standing committees — audit, compensation, and nominating and corporate governance — each of which operates under a charter approved by our Board of Directors. Copies of each committee’s charter is available on the Investor Relations section of our website, which is located at www.gipreit.com. Each committee has the composition and responsibilities described below. Our Board of Directors may from time to time establish other committees.

Audit Committee

Our audit committee consists of Patrick Quilty, Betsy Peck and Stuart Eisenberg, with Mr. Eisenberg serving as the chair of the committee. Our Board of Directors has determined that each of the members of our audit committee satisfies the Nasdaq Marketplace Rules and SEC independence requirements. The functions of this committee include, among other things:

Our Board of Directors has determined that Mr. Eisenberg qualifies as an “audit committee financial expert” within the meaning of applicable SEC regulations and meets the financial sophistication requirements of the Nasdaq Marketplace Rules. Both our independent registered public accounting firm and management periodically will meet privately with our audit committee. Our Audit Committee met four times during 2023.

Compensation Committee

Our compensation committee consists of Benjamin Adams, Gena Cheng and Patrick Quilty, with Mr. Adams serving as the chair of the committee. Our Board has determined that each of the members of our compensation committee satisfies the Nasdaq Marketplace Rules independence requirements. The functions of this committee include, among other things:

14

Our Chief Executive Officer typically attends compensation committee meetings, except for executive sessions (unless specifically requested by the compensation committee to be present). Our Chief Executive Officer may provide recommendations with respect to compensation for the executive officers. The compensation committee considers these recommendations, but may approve, reject or adjust them as it deems appropriate.[LC1]

[LC1]Disclose any role of executive officers in determining or recommending the amount or form of executive and director compensation.

Our Compensation Committee met once during 2023.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Betsy Peck, Gena Cheng, Stuart Eisenberg, and Patrick Quilty, with Ms. Peck serving as the chair of the committee. Our Board of Directors has determined that each of the members of this committee satisfies the Nasdaq Marketplace Rules independence requirements. The functions of this committee include, among other things:

Our Nominating and Corporate Governance Committee met twice during 2023.

We do not have a policy regarding the consideration of any director candidates that may be recommended by our stockholders, including the minimum qualifications for director candidates, nor has our board established a process for identifying and evaluating director nominees. We have not adopted a policy regarding the handling of any potential recommendation of director candidates by our stockholders, including the procedures to be followed. Our board has not considered or adopted any of these policies, as we have never received a recommendation from any stockholder for any candidate to serve on our Board. While there have been no nominations of additional directors proposed, in the event such a proposal is made, our current board will participate in the consideration of director nominees.

Board of Directors’ Role in Risk Oversight

The Board of Directors plays a significant role in monitoring risks to the Company. Where major risks are involved, the Board of Directors takes a direct role in reviewing those matters. The Board of Directors also approves any strategic initiatives and any large or unusual investment or other such expenditure of the Company’s resources. The Board of Directors has established committees to assist in ensuring that material risks are identified and managed appropriately. Among them are the audit committee, the compensation committee, and the nominating and governance committee. The Board of Directors and its committees regularly review material operational, financial, compensation and compliance risks with executive management. The audit committee is responsible for assisting the Board of Directors in its oversight of the quality and integrity of our accounting, auditing, and reporting practices and discussing with management our processes to manage business and financial risk. The compensation committee considers risk in connection with its design of our compensation programs for our executives. The nominating and governance committee regularly reviews the Company’s corporate governance structure and board committee assignments. Each committee regularly reports to the Board of Directors.

Delinquent Section 16(A) Reports

15

Section 16(a) of the Exchange Act requires our executive officers and directors, and beneficial owners of more than 10% of our common stock to file reports regarding ownership of, and transactions in, our securities with the SEC and to provide us with copies of those filings. Based solely on our review of the copies of such forms received by us, we believe that during the twelve months ended December 31, 2023, all Section 16(a) filing requirements applicable to our officers, directors and greater than 10% beneficial owners were timely filed.

Code of Ethics

We have adopted a code of ethics applicable to all employees and directors, including our Chief Executive Officer and Chief Financial Officer. We have posted the text of our code of ethics to our internet website: http://www.gipreit.com by clicking “Investors” at the top, then “Governance”, then "Governance Documents", and finally “Code of Ethics”. We intend to disclose any change to or waiver from our code of ethics by posting such change or waiver to our internet website within the same section as described above.

Anti-Hedging Policies

Our Board of Directors has adopted an Insider Trading Policy which applies to all our directors, officers and designated employees. The policy prohibits our directors, officers and designated employees from engaging in hedging transactions, short sales and transactions in publicly traded options, such as puts, calls and other derivatives, involving our equity securities.

Board and Committee Meetings

During 2023, our Board of Directors held seven meetings. During 2023, no director attended less than 75% of the Board of Directors’ and applicable committee meetings. In addition, the independent directors met in executive session periodically in 2023. We have not established a policy with regard to the attendance of board members at annual stockholder meetings.

Director Attendance at Annual Meeting of Stockholders

We do not have a formal policy regarding the attendance of our directors at our annual meetings of stockholders. Mr. Sobelman was the only director who attended our 2023 Annual Meeting of Stockholders, although all of our other directors listened in to the meeting through a telephone connection.

Communications with the Board

We have established procedures by which stockholders may communicate with members of the Board of Directors, individually or as a group. Stockholders wishing to communicate with the Board of Directors or a specified member of the Board may send written communications addressed to: Board of Directors, Generation Income Properties, Inc., Attention: David Sobelman, Chief Executive Officer, 401 E Jackson Street, Suite 3300, Tampa, Florida 33602. The mailing envelope should clearly specify the intended recipient or recipients, which may be the Board of Directors as a group or an individual member of the Board. The communication should include the stockholder’s name and the number of shares owned. Communications that are not racially, ethically or religiously offensive, commercial, pornographic, obscene, vulgar, profane, defamatory, abusive, harassing, threatening, malicious, false or frivolous in nature will be promptly forwarded to the specified members of the Board of Directors. We have also established procedures by which all interested parties (not just stockholders) may communicate directly with our non-management or independent directors as a group. Any interested party wishing to communicate with our non-management or independent directors as a group may send written communications addressed to: Board of Directors, Generation Income Properties, Inc., Attention: David Sobelman, Chief Executive Officer, 401 E Jackson Street, Suite 3300, Tampa, Florida 33602. The mailing envelope should clearly specify the intended recipients, which may be the non-management directors or the independent directors as a group. The envelope will be promptly forwarded for distribution to the intended recipients.

16

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2024

The audit committee of the Board of Directors has appointed CohnReznick LLP as the Company’s independent registered public accounting firm for our fiscal year ending December 31, 2024. The Board of Directors concurs with the appointment and is submitting the appointment of CohnReznick LLP as our independent registered public accounting firm for stockholder ratification at the Annual Meeting.

Our bylaws do not require that the stockholders ratify the appointment of CohnReznick LLP as our independent registered public accounting firm. We are seeking ratification because we believe it is a sound corporate governance practice. If the stockholders do not ratify the appointment, our audit committee will reconsider whether to retain CohnReznick LLP, but may retain CohnReznick LLP in any event. Even if the appointment is ratified, the audit committee, in its discretion, may change the appointment at any time during the year if it determines that a change would be in the best interests of the Company and its stockholders.

MaloneBailey LLP served as the Company’s independent registered public accounting firm for the Company’s fiscal years ended December 31, 2023 and 2022, and the subsequent interim periods through July 19, 2024. On July 19, 2024, the Company determined that MaloneBailey LLP would no longer serve as the Company’s independent registered public accounting firm and would be dismissed effective as of such date.

During the Company’s fiscal years ended in December 31, 2023 and 2022, and the subsequent interim periods through July 19, 2024, the effective date of MaloneBailey’s dismissal, there were no “disagreements” (as defined in Item 304(a)(1)(iv) of Regulation S-K) between MaloneBailey and the Company on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which disagreements, if not resolved to the satisfaction of MaloneBailey, would have caused MaloneBailey to make reference thereto in its reports on the financial statements for such years. Also, there have been no “reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K). MaloneBailey’s report on the Company’s consolidated financial statements for the fiscal year ended December 31, 2022 did not contain any adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles. Malone Bailey’s report on the Company’s consolidated financial statements for the fiscal year ended December 31, 2023, contained an explanatory paragraph related to the Company’s ability to continue as a going concern, but did not contain an adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to audit scope or accounting principles.

During the fiscal years ended December 31, 2023 and 2022, and the subsequent interim period through July 19, 2024, neither the Company, nor any party on behalf of the Company, consulted with CohnReznick with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of the audit opinion that might be rendered with respect to the Company’s consolidated financial statements, and no written report or oral advice was provided to the Company by CohnReznick that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was subject to any disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a reportable event (as defined in Item 304(a)(1)(v) of Regulation S-K).

On July 19, 2024, the audit committee of the Board of Directors approved the engagement of CohnReznick LLP to replace MaloneBailey LLP, effective immediately

We expect that representatives of CohnReznick LLP will be either physically present or available via phone at the Annual Meeting. CohnReznick will be given the opportunity to make a statement if they desire to do so, and they will be available to respond to appropriate questions after the meeting. We do expect that representatives of MaloneBailey LLP will be physically present or available via phone at the Annual Meeting.

17

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF COHNREZNICK LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL 2024.

AUDIT FEES

The following table sets forth the aggregate fees for services related to the years ended December 31, 2023 and 2022 provided by MaloneBailey, LLP, our principal accountants:

|

2023 |

|

|

2022 |

|

||

Audit Fees (1) |

$ |

398,815 |

|

|

$ |

307,150 |

|

Audit-Related Fees (2) |

|

- |

|

|

|

- |

|

Tax Fees (3) |

|

75,000 |

|

|

|

38,570 |

|

All Other Fees (4) |

|

- |

|

|

|

- |

|

Total |

$ |

473,815 |

|

|

$ |

345,720 |

|

Pre-Approval Policy

The audit committee is required to pre-approve the audit and non-audit services performed by the Company’s independent auditor to assure that the provision of such services does not impair the auditor’s independence. The SEC’s rules establish two approaches for pre-approving services. The two approaches are not mutually exclusive: (1) the audit committee may pre-approve each particular service on a case-by-case basis (“separate pre-approval”), and (2) the audit committee may adopt a pre-approval policy that is detailed as to the particular types of services that may be provided by the independent auditor without consideration by the audit committee on a case-by-case basis (“policy-based pre-approval”). The audit committee has adopted the policy-based pre-approval approach for all auditing and non-auditing services and has pre-approved such services for the years ending December 31, 2021, 2022 and 2023. Furthermore, the audit committee has delegated this authority to the chairman of the audit committee for situations when pre-approval by the full audit committee is inconvenient. Any decisions by the chairman of the audit committee must be disclosed at the next audit committee meeting.The audit committee approved 100% of all services provided by MaloneBailey during 2023 and 2022.

18

AUDIT COMMITTEE REPORT

The audit committee oversees the financial reporting processes of Generation Income Properties, Inc. on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in the Annual Report with management and discussed with management the quality, in addition to the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The audit committee reviewed with representatives of MaloneBailey LLP, the Company’s independent registered public accounting firm responsible for auditing the company’s financial statements and expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States of America, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles. The audit committee has discussed with the independent registered public accounting firm the matters required to be discussed under auditing standards adopted by the Public Company Accounting Oversight Board. The audit committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence and has discussed with the independent accountant the independent accountant’s independence.

The audit committee discussed with representatives of MaloneBailey LLP, the overall scope and plans for their audit. The audit committee met with representatives of MaloneBailey LLP, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the audit committee recommended to the Board of Directors the inclusion of the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, for filing with the Securities and Exchange Commission.

This report of the audit committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference and shall not otherwise be deemed filed under such acts.

AUDIT COMMITTEE

Stuart Eisenberg, Chairman

Patrick Quilty

Betsy Peck

19

EXECUTIVE OFFICERS

Set forth below is a summary of the background and experience of our executive officer other than David Sobelman. Information about David Sobelman is set forth under “Directors.” There is no family relationship among any of the directors and/or executive officers of the Company.

Ron Cook, age 45, was hired as our Vice President of Accounting and Principal Finance and Accounting Officer effective November 15, 2023. Mr. Cook is a consultant with One10 Advisors (“One10”), a Tampa-based accounting firm, and One10 will provide the services of Mr. Cook until November 14, 2024, with a single twelve-month automatic renewal period. Mr. Cook has provided management consulting services through Cook Financial Partners since 2008 through the present, serving a broad range of clients with outsourced business and financial advisory services. Mr. Cook served as Chief Financial Officer and Strategic Advisor of The Peebles Corporation ("Peebles"), a privately-held real estate investment and development firm, from 2019 through 2022. Peebles develops mixed-use, multifamily, office and retail properties through direct investment and through public-private partnerships. Mr. Cook oversaw all financial functions, acquisitions and development, and strategic initiatives. From 2014 through 2018, he served as a Senior Manager in the boutique management consultancy Riveron Consulting ("Riveron"). Riveron advises private equity firms and publicly traded companies in business strategy, mergers and acquisitions, and financial compliance. At Riveron, Mr. Cook served clients across various industries through services spanning transaction advisory, IPO readiness and execution, and business strategy. Prior to Riveron, Mr. Cook served several real estate firms, including Jair Lynch Real Estate Partners, Hines Interests and Ross Management Services, in various finance and accounting roles. Mr. Cook began his career at Reznick, Fedder and Silverman (now CohnReznick) as an auditor, exclusively for real estate clients. He is a graduate of James Madison University with a Bachelor’s degree in Finance, the University of Maryland GC, with a Master's degree in Accounting, and the University of Virginia Darden School of Business with a Master's degree in Business Administration.

EXECUTIVE COMPENSATION

The following describes the material compensation arrangements with the executive officers named in the Summary Compensation Table below (referred to as our "named executive officers"):

David Sobelman. On August 26, 2024, the Company entered into a Second Amended and Restated Employment Agreement (the “Amended Employment Agreement”) with David Sobelman, the Company’s President and Chief Executive Officer. The Amended Employment Agreement, which was approved by the Company’s Board of Directors on August 26, 2024 (the “Board”), amends and restates in its entirety the First Amended and Restated Employment Agreement, dated June 23, 2022, previously entered into between the Company and Mr. Sobelman.

The Amended Employment Agreement provides that Mr. Sobelman will continue to receive a base salary of $200,000 per year, provided that the annual base salary will increase to (i) $300,000 upon the Company and its subsidiaries achieving $115 million or greater in gross asset value of real estate assets owned, (ii) $400,000 upon the Company and its subsidiaries achieving $150 million or greater in gross asset value of real estate assets owned, and (iii) $600,000 upon the Company and its subsidiaries achieving $500 million or greater in gross asset value of real estate assets owned. The base salary may be increased, but not decreased, in the discretion of the Board. The Amended Employment Agreement further provides that Mr. Sobelman will receive an annual nondiscretionary bonus on the first trading day of each December during the term of employment in the amount of 35% of his base salary then in effect. In addition, Mr. Sobelman will be entitled to receive, upon approval of the board, a discretionary annual performance-based bonus with a bonus target amount of 200% (and a bonus opportunity of up to 300%) of his then- current salary based on the Company materially meeting the Board-approved budget for the immediately preceding fiscal year.

In addition to the base salary and the foregoing bonuses, the Amended Employment Agreement provides that Mr. Sobelman will be paid $7,500 a year to be used solely to cover the actual cost to Mr. Sobelman of obtaining a death and disability insurance policy on his life for and for related costs and expenses. He will also be entitled to a guarantee fee for Company obligations that are personally guaranteed by Mr. Sobelman (but only if the personal guaranty is approved by the Board), with the amount of the guarantee fee being 1% of the guaranteed amount for a full guarantee and 0.5% for a non-recourse or fraud exception guarantee (with the guarantee fee increased to 10% on the 60th day following a termination without “cause” or termination for “good reason”, as those terms are defined in the agreement, unless the guarantee is removed during such 60-day period). Mr. Sobelman is also eligible to receive such medical, health, vacation, and other benefits as are provided by the Company and its subsidiaries generally, and Mr. Sobelman will be eligible to participate in any 401(k) plan that the Company or its related entities may adopt in the future.

20

The Amended Employment Agreement provides that, on the first trading date of December of each year during the term of Mr. Sobelman’s employment, Mr. Sobelman will receive an annual grant of fully vested stock under the Generation Income Properties, Inc. 2020 Omnibus Incentive Plan for a number of shares equal to Executive’s base salary as then in effect divided by the higher of the closing price of the Company’s common stock on the grant date or $10.00 per share.

Under the Amended Employment Agreement, Mr. Sobelman is subject to non-solicitation and non-competition covenants that expire one year following termination of employment and to customary confidentiality obligations.

The term of Mr. Sobelman’s employment under the Amended Employment Agreement will continue until terminated by either the Company or Mr. Sobelman at any time, whether or not for cause, upon 60-days notice to the other party or until Mr. Sobelman’s death or disability. The Amended Employment Agreement may also be terminated by the Company for “cause” (as defined in the agreement) or by Mr. Sobelman for “good reason” (as defined in the agreement). “Good reason” includes certain changes in Mr. Sobelman’s responsibilities or duties without his consent, reductions in compensation or a material reduction in benefits, a material breach by the Company of the Amended Employment Agreement that remains uncured following notice of the breach, or a material relocation of his principal place of employment without his consent.

In the event that the Company terminates Mr. Sobelman’s employment without cause or Mr. Sobelman resigns for good reason, the Amended Employment Agreement provides that Mr. Sobelman will be entitled to receive severance compensation equal to two times (or three times if the termination occurs within 12 months of a “change in control”, as defined in the agreement) the sum of his then-current base salary plus his average bonus for the preceding three years. For this purpose, Mr. Sobelman’s then-current base salary shall be deemed to be equal to what his base salary would have then been if the properties included in the Company’s acquisition pipeline (as approved from time to time by the chair of the Board Compensation Committee) had been acquired prior to employment termination. In addition, in such event, Mr. Sobelman will be entitled to additional separation compensation in an amount equal to the premium payments for continuing healthcare coverage for Mr. Sobelman and his family for a period of 18 months. The foregoing severance compensation, if due, will be paid in 18 equal monthly installments. In addition, upon a termination without cause or for good reason, any unvested equity awards (if any) held by Mr. Sobelman will immediately vest.

Ron Cook. The Board of Directors of the Company appointed Ron Cook to serve as the Company’s Vice President of Accounting effective as of November 15, 2023. In his capacity as Vice President of Accounting, Mr. Cook will serve as the Company’s principal financial and accounting officer. Mr. Cook is a consultant with One10 Advisors (“One10”), a Tampa-based accounting firm, and One10 will provide the services of Mr. Cook until November 14, 2024, with a single twelve-month automatic renewal period, at a rate of $200 per hour pursuant to an engagement letter that may be terminated by the Company at any time.

Outstanding Equity Awards at Fiscal Year-End

As of December 31, 2023, there were 19,366 unvested stock awards held by the named executive officers. None of our executive officers own vested or unvested stock options.

Equity-Based Incentive Compensation

An important element of our total executive compensation is our equity award program. We believe that our equity award program serves a number of important corporate objectives, most importantly the alignment of our executives’ interests with our stockholders’ interests. Our equity award program helps to ensure that each of our executives and directors have a significant portion of their net worth tied to the performance of our stock. We plan to grant additional restricted stock with time-based vesting under our long-term equity incentive program. The Generation Income Properties, Inc. 2020 Omnibus Incentive Plan (the “Omnibus Incentive Plan”) permits our Compensation Committee to grant stock options, stock appreciation rights, performance shares, performance units, shares of common stock, restricted stock, restricted stock units, cash incentive awards, dividend equivalent units, or any other type of award permitted under the Omnibus Incentive Plan. The Omnibus Incentive Plan provides that 2,000,000 shares of our common stock are reserved for issuance under the plan.

21

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to our named executive officers for all services rendered in all capacities to us for each of the years ended December 31, 2023 and 2022.

Name and Principal Position |

Year |

Salary |

Bonus |

Stock Awards |

All Other Compensation |

Total |

David Sobelman, President and CEO |

2023 |

$ 200,000 |

$ 96,250 |

$ 110,000 |

$ 313,909(1) |

$ 720,159 |

|

2022 |

$ 150,000 |

$ 70,000 |

$ - |

$ 138,300 (2) |

$ 358,300 |

Ron Cook, Vice President of Accounting |

2023 |

$ 26,000 |

$ - |

$ - |

|

$ 26,000 |

Allison Davies, Former CFO |

2023 |

$ 192,500 |

$ - |

$ 110,000 |

$ 57,659(3) |

$ 360,159 |

|

2022 |

$ 183,333 |

$ 66,000 |

$ - |

$ 5,795 |

$ 255,128 |

Richard Russell, Former CFO |

2022 |

$ 30,333 |

$ - |

$ - |

$ - |

$ 30,333 |

(1) |

Consists of health insurance premiums of $23,593 and guarantee fees payable to Mr. Sobelman of $290,316. |

(2) |

Consists of health insurance premiums of $9,249 and guarantee fees payable to Mr. Sobelman of $129,051. |

(3) |

Separation payment paid to Ms. Davies per the separation and release agreement entered into as of October 3, 2023. |

PRINCIPAL STOCKHOLDERS

The following table sets forth information regarding the beneficial ownership of our common stock as of October 11, 2024 by:

The number and percentage of shares beneficially owned are based on 5,423,188 common shares outstanding as of October 11, 2024. Information with respect to beneficial ownership has been furnished by each director, officer or beneficial owner of more than 5% of our common stock. Beneficial ownership is determined in accordance with the rules of the SEC, which generally require that the individual have voting or investment power with respect to the shares. In computing the number of shares beneficially owned by an individual listed below and the percentage ownership of that individual, shares underlying options, warrants and convertible securities held by each individual that are exercisable or convertible within 60 days of October 11, 2024, are deemed owned and outstanding, but are not deemed outstanding for computing the percentage ownership of any other individual. Except as otherwise indicated in the footnotes to this table, or as required by applicable community property laws, all individuals listed have sole voting and investment power for all shares shown as beneficially owned by them. Unless otherwise indicated below, the address for each principal stockholder is Generation Income Properties, Inc., 401 E Jackson Street, Suite 3300, Tampa, Florida 33602.

22

|

Shares Beneficially Owned |

||||||

|

Title or Class of Securities |

||||||

|

Common Stock (1) |

|

|

||||

Name and Address of Beneficial Owner |

Number of Shares Beneficially Owned |

|

Percentage Beneficially Owned |

|

|

||

5% Stockholders: |

|

|

|

|

|

||

John Robert Sierra Sr. Revocable Family Trust (2) |

|

226,100 |

|

|

4.1 |

% |

|

Thomas E. Robinson (3) |

|

206,000 |

|

|

3.8 |

% |

|

|

|

|

|

|

|

||

Executive Officers and Directors |

|

|

|

|

|

||

Benjamin Adams (4) |

|

20,971 |

|

* |

|

|

|

Gena Cheng (5) |

|

15,946 |

|

* |

|

|

|

Ron Cook |

|

- |

|

* |

|

|

|

Allison Davies (6) |

|

19,366 |

|

* |

|

|

|

Stuart Eisenberg (7) |

|

26,946 |

|

* |

|

|

|

Betsy Peck (8) |

|

40,946 |

|

* |

|

|

|

Patrick Quilty (9) |

|

24,446 |

|

* |

|

|

|

David Sobelman (10) |

|

156,384 |

|

|

2.9 |

% |

|

All executive officers and directors as a group (7 persons) |

|

305,004 |

|

|

5.6 |

% |

|

|

|

|

|

|

|

||

*Represents less than 1% of beneficial ownership |

|

|

|

|

|

||

23

SHAREHOLDER PROPOSALS FOR PRESENTATION AT THE 2024 ANNUAL MEETING

Shareholder proposals intended to be considered for inclusion in next year’s proxy statement and form of proxy for presentation at the 2025 annual meeting of stockholders must comply with Rule 14a-8 of the Exchange Act. The deadline for submitting such proposals is June 19, 2025 (120 days before the date of this year’s mailing without regard to the year), unless the date of the 2025 annual meeting is more than 30 days before or after the one-year anniversary date of this 2024 Annual Meeting, in which case proposals must be submitted a reasonable time before we print our proxy materials for the next annual meeting.