Exhibit 15.2

NOTE AND LOAN MODIFICATION AGREEMENT

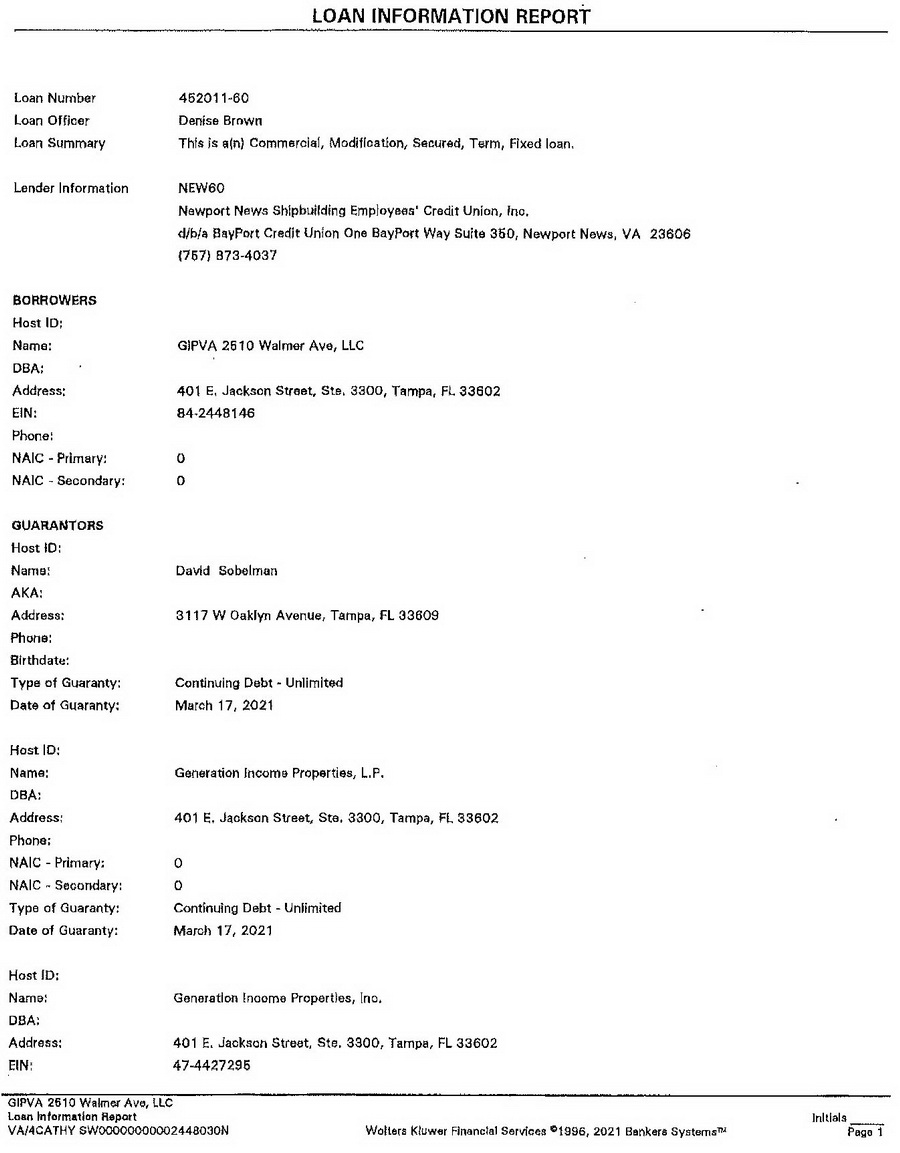

This Note and Loan Modification Agreement (this “Agreement”) is made as of March 23, 2021, by and among GIPVA 130 CORPORATE BLVD, LLC, a Delaware limited liability company (the “Borrower”), GENERATION INCOME PROPERTIES, L.P., a Delaware limited partnership, GENERATION INCOME PROPERTIES, INC., a Maryland corporation, and DAVID SOBELMAN (collectively, the “Guarantors” and together with the Borrower, the “Obligors”),,and NEWPORT NEWS SHIPBUILDING EMPLOYEES’ CREDIT UNION, INC., D/B/A BAYPORT CREDIT UNION (the “Credit Union”), who, in consideration of the mutual covenants herein and for Ten Dollars and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, agree as follows:

1. Recitals.

A. The Borrower is indebted to the Credit Union (the “Loan”) under that certain Promissory Note dated October 23, 2017, made by Riverside Crossing, L.C. (“Riverside Crossing”) in the original face amount of $5,220,000 as amended by an Allonge to Promissory Note dated as of September 30, 2019 (collectively, the ’‘Note”) which Loan was assumed by the Borrower, and modified, by that certain Note, Deed of Trust, Assignment of Leases and Rents and Related Documents Assignment, Assumption and Modification Agreement (the “Assumption Agreement”) dated as of September 30, 2019, by and among Riverside Crossing, Borrower, and Credit Union, and joined in by the Guarantors.

B. The Borrower has requested the Credit Union to reduce the interest rate payable on the Loan and adjust the monthly payments thereon.

C. The Credit Union has agreed to the Borrower’s request on the terms and conditions hereinafter set forth, and the parties now agree to modify the Note and the Loan evidenced thereby.

D. The obligations of the Borrower and the other Obligors under the Loan Documents (as defined in the Assumption Agreement) as modified herein, and all renewals, extensions, amendments, supplements and restatements thereof, are hereinafter collectively referred to as the “Obligations.” The Loan Documents (as defined in the Assumption Agreement), as modified herein, and any other document now or hereafter executed and delivered to evidence, secure, or guarantee the Obligations or any part thereof, or delivered in connection with the Loan or executed and delivered in connection with, or pertaining to, the Note, as modified herein, as such documents or any of them may be renewed, extended, amended, supplemented or restated from time to time, are hereinafter collectively referred to as the “Loan Documents.” Terms defined in the Loan Documents and not redefined in this Agreement shall have the same meanings in this Agreement as assigned in the Loan Documents.

2. Note and Loan Modifications.

2.1 The Note and the Commercial Loan Agreement, and the Loan evidenced thereby, are hereby modified as follows:

A. In the header of the Note and the Commercial Loan Agreement under the caption “RATE” the verbiage shall be amended to read as follows: “4.250% per annum through March 23, 2021, and 3.50% per annum thereafter.”

B. Section 3 of the Note captioned “INTEREST” is hereby amended by deleting the first sentence in its entirety and inserting the following provisions in lieu thereof:

“Interest will accrue on the unpaid principal balance of this Note at the per annum rate of 4.250 percent through March 23, 2021, and at the per annum rate of 3,50 percent thereafter (Interest Rate),”

C. Section 6 of the Note captioned “PAYMENT” is hereby amended by deleting the first paragraph and inserting the following provisions in lieu thereof:

“PAYMENT. I agree to pay this Note in 84 payments, This Note is amortized over 300 payments, I will make 23 payments of $28,178,38 beginning on November 23, 2017, and on the 23rd day of each month thereafter through September 23, 2019. I will make 18 payments of $29,583.00 beginning on October 23, 2019, and on the 23rd day of each month thereafter through March 23, 2021. I will make 42 payments of $27,432.38 beginning on April 23, 2021, and on the 23rd day of each month thereafter through September 23, 2024. The 43rd and final “balloon payment” of the entire unpaid balance of Principal and interest will be due October 23, 2024,”

2.2 The Second Allonge to Promissory Note attached hereto as Exhibit A is hereby approved and shall be executed by the parties and affixed to the Note and made a part thereof.

2.3 Any provision in the Loan Documents to the extent it is inconsistent with the modifications made by this Agreement shall be deemed to be amended and restated to be consistent in all respects,

3. Representations and Warranties. The Borrower and the other Obligors hereby represent and warrant that (a) the execution and delivery of this Agreement do not contravene, result in a breach of, or constitute a default under, any loan agreement, indenture or other contract or agreement to which the Borrower or any of the other Obligors is a party or by which the Borrower or any of the other Obligors or any of their respective properties may be bound (nor would such execution and delivery constitute such a default with the passage of time or the giving of notice or both), and do not violate or contravene any law, order, decree, rule, regulation or restriction to which the Borrower or any of the other Obligors or any of their respective properties may be bound; (b) the Borrower and the other Obligors are validly existing under the laws of the State of their respective formation, (c) this Agreement constitutes the legal, valid and binding obligations of the Borrower and the other Obligors, enforceable in accordance with its terms; (d) the execution and delivery of, and performance under, this Agreement is within the Borrower’s and each of the other Obligors’ power and authority, without the joinder or consent of any other party, and have been duly authorized by all requisite action and are not in contravention of law or,

- 2 -

with respect to the Borrower and the other Obligors, their respective organizational documents, or of any indenture, agreement or undertaking to which the Borrower or any of the other Obligors is a party or by which any of them are bound. The Borrower and the other Obligors, jointly and severally, agree to indemnify and hold the Credit Union harmless from and against any loss, claim, damage, liability or expense (including, without limitation, reasonable attorneys’ fees) incurred as a result of any representation or warranty made by the Borrower or the other Obligors herein which proves to be untrue or inaccurate in any respect.

4. Further Assurances. The Borrower and the other Obligors, jointly and severally, agree to execute and deliver to the Credit Union, promptly upon request from the Credit Union, such additional documents as may be necessary or appropriate to consummate the transactions contemplated herein,

5. No Novation. Nothing herein shall in any manner diminish, impair or extinguish the Obligations. The execution and delivery of this Agreement shall not constitute a novation of the debt evidenced by the Note. The Borrower and the other Obligors ratify and acknowledge the Loan Documents, as amended by this Agreement, as valid, subsisting and enforceable and agree and warrant that there are no offsets, claims or defenses with respect to the Obligations.

6. No Waiver by the Credit Union. The Borrower and the other Obligors acknowledge and agree that the execution of this Agreement by the Credit Union is not intended nor shall it be construed as (a) an actual or implied waiver of any default under any of the Loan Documents, or

(b) an actual or implied waiver of any condition or obligation imposed upon the Borrower or the other Obligors pursuant to the Note, as modified by this Agreement, or any other Loan Documents, except to the extent, if any, specified herein.

7. Expenses. The Borrower and the other Obligors agree, jointly and severally, to pay all costs and expenses and reimburse the Credit Union for any and all expenditures of every character incurred or expended from time to time, regardless of whether a default shall have occurred, in connection with (a) this Agreement (including, without limitation, the Credit Union’s legal expenses incurred in connection with the drafting of this Agreement); (b) all costs and expenses relating to the Credit Union’s exercise of any of it rights and remedies under any of the Loan Documents or at law, including, without limitation, attorneys’ fees, legal expenses, and court costs.

9. Reaffirmation. The Borrower and other Obligors, by signature below, for a valuable consideration, the receipt and adequacy of which are hereby acknowledged, hereby declare to, and agree with, the Credit Union that the Borrower and the other Obligors are as set forth therein, liable under the Note and other Loan Documents (including, without limitation, the Guarantors’ Guaranty of Nonrecourse Carveout Liabilities and Obligations), as amended by this Agreement, that there are no offsets, claims or defenses of the Borrower or other Obligors with respect to the Obligations, and that the Note and other Loan Documents (including, without limitation, the Guarantors’ Guaranty of Nonrecourse Carveout Liabilities and Obligations) as modified hereby are hereby ratified and confirmed in all respects.

10. Miscellaneous. As hereby expressly modified by this Agreement, all terms of the Note and other Loan Documents remain in full force and effect. This Agreement (a) shall be

- 3 -

binding upon and inure to the benefit of the parties hereto and their respective heirs, beneficiaries, administrators, executors, receivers, trustees, successors and assigns (provided, however, no party other than the Credit Union shall assign its rights hereunder without the prior written consent of the Credit Union); (b) may be modified or amended only by a writing signed by the parties hereto; (c) shall be governed by (including but not limited to its validity, enforcement and interpretation) the laws of the Commonwealth of Virginia and United States federal law; (d) may be executed in several counterparts, and by the parties hereto on separate counterparts, and each counterpart, when executed and delivered, shall constitute an original agreement enforceable against all who signed it without production of or accounting for any other counterpart, and all separate counterparts shall constitute the same agreement; and (e) embodies the entire agreement and understanding between the parties with respect to modifications of Loan Documents provided for herein and supersedes all prior conflicting or inconsistent agreements, consents and understandings relating to such subject matter. Whenever used herein, the singular number shall include the plural and the plural the singular, and any gender shall be applicable to all genders. The use of the words “herein”, “hereof’’, “hereunder” and other similar compounds of the word “here” shall refer to this entire Agreement and not to any particular section, paragraph or provision. The headings in this Agreement shall be accorded no significance in interpreting it.

EXECUTED on the date or dates of the acknowledgements hereof, but effective as of the date first stated in this Agreement.

[Signature Pages Follow]

- 4 -

[Counterpart signature page to Note and Loan Modification Agreement]

BORROWER:

GIPVA 130 CORPORATE BLVD, LLC,

a Delaware limited liability company

By: Generation Income Properties, L.P.,

a Delaware limited partnership, Sole Member

By: Generation Income Properties, Inc.,

a Maryland corporation General Partner

By: /s/ David Sobelman

David Sobelman, President

- 5 -

[Counterpart signature page to Note and Loan Modification Agreement]

GUARANTOR:

Generation Income Properties, Inc.,

a Maryland corporation

By: /s/ David Sobelman

David Sobelman, President

- 6 -

[Counterpart signature page to Note and Loan Modification Agreement]

GUARANTOR:

Generation Income Properties, L.P.,

a Delaware limited partnership

By: Generation Income Properties, Inc.,

a Maryland corporation, General Partner

By: /s/ David Sobelman

David Sobelman, President

- 7 -

[Counterpart signature page to Note and Loan Modification Agreement]

GUARANTOR:

/s/ David Sobelman

David Sobelman

- 8 -

[Counterpart signature page to Note and Loan Modification Agreement]

CREDIT UNION:

NEWPORT NEWS SHIPBUILDING

EMPLOYEES’ CREDIT UNION, INC. d/b/a

BAYPORT CREDIT UNION

By: /s/ Denise Brown

Denise Brown, Commercial Banker

- 9 -

EXHIBIT A

SECOND ALLONGE

TO

PROMISSORY NOTE

(Loan No, 412398-60)

ORIGINAL BORROWER: Riverside Crossing L.C.

CURRENT BORROWER: GIPVA 130 Corporate Blvd, LLC

LENDER: Newport News Shipbuilding Employees’ Credit Union, Inc.,

d/b/a BayPort Credit Union

This Second Allonge to Promissory Note (the “Second Allonge”) is dated and effective as of March 23, 2021, and attached to, and made a part of, the Promissory Note dated October 23, 2017, made by the Original Borrower payable to the Lender or order, in the face amount of$5,200,000.00, as previously amended by Allonge to Promissory Note dated as of September 30, 2019 (collectively, the “Note”). The obligations of the Original Borrower under the Note were assumed by the Current Borrower pursuant to that certain Note, Deed of Trust, Assignment of Leases and Rents, and Related Loan Documents Assignment, Assumption and Modification Agreement (the “Assumption Agreement”), by and among the Original Borrower, the Current Borrower, the Lender and James B. Mears as Trustee and joined in by Generation Income Properties, L.P., a Delaware limited partnership, Generation Income Properties, Inc., a Maryland corporation, and David Sobelman (collectively, the “Guarantors”), Any capitalized term used, but not defined, in this Allonge shall have the meaning ascribed to such term in the Note or the Assumption Agreement.

The Note is hereby amended as follows:

1, In the header under the caption “RATE” the verbiage shall be amended lo read as follows: “4.250% per annum through March 23, 2021, and 3.50% per annum thereafter.”

2. Section 3, captioned “INTEREST” is hereby amended by deleting the first sentence in its entirety and inserting the following provisions in lieu thereof:

“Interest will accrue on the unpaid principal balance of this Note at the per annum rate of 4,250 percent through March 23, 2021, and at the per annum rate of 3.50 percent thereafter (Interest Rate).”

3. Section 6 captioned “PAYMENT” is hereby amended by deleting the first paragraph and inserting the following provisions in lieu thereof:

“PAYMENT. I agree to pay this Note in 84 payments, This Note is amortized over 300 payments. I will make 23 payments of $28,178.38 beginning on November 23, 2017, and on the 23rd day of each month thereafter through September 23, 2019. I

A-1

will make 18 payments of $29,583,00 beginning on October 23, 2019, and on the 23rd day of each month thereafter through March 23, 2021. I will make 42 payments of $27,432.38 beginning on April 23, 2021, and on the 23rd day of each month thereafter through September 23, 2024. The 43rd and final “balloon payment” of the entire unpaid balance of Principal and interest will be due October 23, 2024.”

4. Except as amended, modified or supplemented by this Second Allonge, the Note remains in full force and effect and is hereby ratified and confirmed.

[Continued on following page]

A-2

CURRENT BORROWER:

GIPVA 130 CORPORATE BLVD, LLC,

a Delaware limited liability company

By: Generation Income Properties, L.P.,

a Delaware limited partnership, Sole Member

By: Generation Income Properties, Inc.,

a Maryland corporation General Partner

By: /s/ David Sobelman

David Sobelman, President

A-3

LENDER:

NEWPORT NEWS SHIPBUILDING

EMPLOYEES’ CREDIT UNION, INC.

d/b/a. BAYPORT CREDIT UNION

By: /s/ Denise Brown

Denise Brown, Commercial Banker

A-4