Exhibit 10.4

LEASE dated February 27, 2006 between TOYS “R” US - DELAWARE, INC., a Delaware corporation, whose address is One Geoffrey Way, Wayne, New Jersey 07470 (“Landlord”) and BEST BUY STORES, L.P., a Virginia limited partnership, 7601 Penn Avenue South, Richfield, Minnesota 55423 (“Tenant”).

Landlord hereby leases to Tenant and Tenant hereby rents from Landlord the Demised Premises (as defined in Article I) for the Term provided for in Article IV hereof at the rent provided for in Article V hereof and on all of the terms and conditions set forth herein. Intending to be legally bound hereunder and in consideration of $1.00 and other good and valuable consideration, Landlord and Tenant hereby agree with each other as follows:

The following terms shall be applicable to the various provisions of this Lease which refer to them:

Section 1.01 Demised Premises and the Shopping Center:

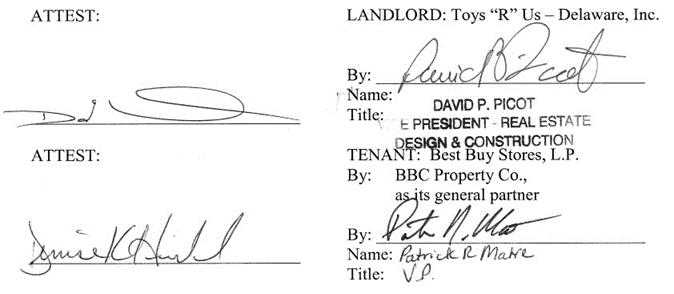

Demised Premises means the “Building” (as hereinafter defined) located in the City of Grand Junction, County of Mesa, State of Colorado. The building leased to Tenant consists of approximately 30,701 square feet of floor area and is designated as “Demised Premises” on Exhibit A, attached hereto and made a part hereof. Included in the definition of the term “Demised Premises” shall be the compactor, balers, and generators in or for the Building. The Demised Premises are located on that certain parcel of land consisting of approximately 3.4 acres (the “Land”), a description of which is annexed hereto as Exhibit A-1. The Demised Premises includes any alterations, additions or repairs made thereto. The Land lies adjacent to certain parcels of land owned by SDG Macerich Properties, L.P. (“Developer”), which parcels of land are more particularly described on Exhibit A-2 attached hereto and made a part hereof (“Developer’s REA Tract”). The Land and Developer’s REA Tract, and any buildings and improvements now or hereafter erected thereon, shall be collectively called the “Shopping Center”. The Land is also adjacent to certain real property owned by Developer known as the Mesa Mall (the “Adjacent Shopping Center”), a description of which is annexed hereto as Exhibit A-3.

Section 1.02 Building:

“Building” means the building containing approximately 30,701 square feet of floor area in which the Demised Premises is located, as shown on Exhibit A.

Section 1.03 Expiration Date:

“Expiration Date” means the January 31st next following the fifteenth (15th) anniversary of the Commencement Date. See Section 19.17 regarding the “Renewal Terms”.

Section 1.04 Rent:

(a)Minimum Rent: Minimum Rent shall be payable as follows: (i) the sum of $332,798.84 per annum during the first five (5) years of the Term; (ii) the sum of $366,078.72 per annum during the sixth (6th) through tenth (10th) years of the Term; and (iii) the sum of $402,686.60 per annum during the balance of the Term.

(b)Percentage of Gross Sales: None.

Section 1.05 Taxes:

(a)Tax Contributions: See Section 5.03.

1

|

|

Section 1.07 |

Security: None. |

|

|

Section 1.08 |

Use: |

(a)Permitted Uses: See Section 9.01.

|

|

Section 1.09 |

Broker: None. |

|

|

Section 1.10 |

Notice Addresses: |

(a)Landlord’s Notice Address:

One Geoffrey Way

Wayne, New Jersey 07470

Attention: Vice President - Real Estate, Design and

Construction

(b)Landlord’s Notice Copy Address:

One Geoffrey Way

Wayne, New Jersey 07470

Attention: Vice President - Real Estate Counsel

Cole, Schotz, Meisel, Forman & Leonard, P.A. Court Plaza North 25 Main Street, P.O. Box 800 Hackensack, New Jersey 07602-800 Attention: Richard W. Abramson, Esq.

(c)Tenant’s Notice Address:

7601 Penn Avenue South

Richfield, Minnesota 55423

Attention: Legal Department-Real Estate

(d)Tenant’s Notice Copy Address:

Robins, Kaplan, Miller & Ciresi, L.L.P.

2800 LaSalle Plaza

800 LaSalle Avenue

Minneapolis, Minnesota 55402-2015

Attention: Steven A. Schumeister, Esq.

ARTICLE II. DEFINITIONS.

As used herein, the following words and phrases have the following meanings:

|

|

Section 2.01 |

Common Area: |

Means the portions of the Shopping Center designated for common use from time to time by Landlord and includes, without limitation, the Parking Area, sidewalks, entrances, exits, service roads, means of ingress and egress, landscaping, common utilities and sewer lines, monument sign and other common facilities including, without limitation, common roadways located in the Shopping Center, Adjacent Shopping Center or located outside of the Shopping Center, but serving the Shopping Center or as otherwise set forth in the REA (as hereinafter defined).

2

Means the last day of the Term. If the Term has been extended or this Lease has been renewed, the Expiration Date shall be the last day of the Term as so extended or renewed. If this Lease is cancelled or terminated prior to the originally fixed Expiration Date, then the Expiration Date shall be the date on which this Lease is so cancelled or terminated.

Section 2.03 Force Majeure:

Means any of the following events: Acts of God; strikes, lock outs, or labor difficulty; explosion, sabotage, accident, riot or civil commotion; act of war; fire or other casualty; legal requirements; delays caused by the other party; any causes beyond the reasonable control of a party (except that the inability to obtain funds shall not be deemed to be a Force Majeure). Notwithstanding anything herein contained the provisions of this Section shall not be applicable to Tenant’s obligations to pay Rent or any other sums or charges payable by Tenant hereunder.

Section 2.04 Insurance Requirements:

Means the applicable provisions of the insurance policies carried by Landlord covering the Demised Premises, the Shopping Center, or any part of either; all requirements of the issuer of any such policy; and all orders, rules, regulations and other requirements of any insurance service office which serves the community in which the Shopping Center is situated.

Section 2.05 Landlord’s Work:

None.

Section 2.06 Master Lease:

Means a lease of the Demised Premises, or a lease of the ground underlying the Demised Premises, between the owner thereof, as lessor, and Landlord, as lessee, giving rise to Landlord’s rights and privileges in the Demised Premises or such underlying land.

Section 2.07 Master Lessor:

Means the owner of the Lessor’s interest under the Master Lease.

Section 2.08 Mortgage:

Means any mortgage, deed to secure debt, trust indenture, or deed of trust which may now or hereafter affect, encumber or be a lien upon the Demised Premises, the Land, the real property of which the Demised Premises forms a part, or Landlord’s interest therein; and any spreading agreements, future advances made pursuant to any existing Mortgage, renewals, modifications, consolidations, replacements and extensions thereof.

Section 2.09 Mortgagee:

Means the holder of any Mortgage, at any time, or any lender providing financing to Landlord.

Section 2.10 Parking Area:

Means those portions of the Shopping Center which are designated as such by Landlord from time to time, subject to the provisions of subsection 11.02(b).

Section 2.11 Person:

3

Means an individual, fiduciary, estate, trust, partnership, firm, association, corporation, or other organization, or a government or governmental authority.

Section 2.12 Tenant’s Pro Rata Share:

Means one hundred (100%) percent.

Section 2,13 Repair:

Includes the words “replacement and restoration”, “replacement or restoration”, “replace and restore”, “replace or restore”, as the case may be.

Section 2.14 Tenant’s Agents:

Includes Tenant’s employees, servants, licensees, tenants, subtenants, assignees, contractors, heirs, successors, legatees, and devisees.

Section 2.15 Tenant’s Work:

Tenant’s Work means the construction and other work designated as Tenant’s Work as set forth in Section 3.04.

Section 2.16 Term:

The Term is as set forth in Sections 1.03 and 4.01 and includes any renewals and extensions thereof.

Section 2.17 Year:

For the purposes of this Lease, the word “year”, wherever appearing herein, shall have the following meaning:

The first year shall commence on the Commencement Date and shall terminate on the 364th day thereafter. Each year thereafter shall commence on the anniversary of the Commencement Date and shall continue for 364 days thereafter (365 days when a leap year occurs), provided, however, that the last year shall terminate on the Expiration Date. The foregoing definition of the word “year” shall not be applicable to a “Lease Year” or a “Tax Fiscal Year” (each as separately defined herein).

Section 2.18 REA:

Means that certain Reciprocal Easement and Operation Agreement dated July 21, 1992 and recorded on July 30, 1992 in Book 1914 at Page 685 in the Office of the Clerk and Recorder of Mesa County, Colorado, between The Equitable Life Assurance Society of the United States and Toys “R” Us, Inc.

ARTICLE III. CONDITION OF DEMISED PREMISES.

Section 3.01 Landlord’s Work:

Tenant shall accept possession of the Demised Premises in its present “as is” condition, except as specifically set forth in Section 7.01. Notwithstanding the foregoing, Landlord shall deliver the Demised Premises with the roof water tight and with the HVAC system in working order.

Section 3.02 Delivery of Possession:

Delivery of Possession shall be deemed to have occurred on the later of (i) date on which Landlord tenders possession of the Demised Premises to Tenant; (ii) March 4, 2006; or (iii) the date of satisfaction of the conditions set forth in Section 19.23 below.. Landlord intends to deliver possession of the Demised Premises to Tenant on March 4, 2006.

Section 3.03 Tenant’s Right of Entry:

4

Tenant may enter the Demised Premises after Delivery of Possession and before the Commencement Date for the purpose of performing Tenant’s Work. Upon and after any entry to the Demised Premises by Tenant, all of Tenant’s obligations under this Lease shall be applicable, except for Tenant’s obligations to pay Rent.

Section 3.04 Tenant’s Work:

(a)Tenant has submitted to Landlord preliminary plans and specifications for the construction of Tenant’s Work (“Tenant’s Plans”), a list of which is attached hereto as Exhibit B. Landlord agrees that Tenant’s Work may be constructed by Tenant, so as to substantially conform to Tenant’s Plans. Tenant may make variations from Tenant’s Plans, provided such variations conform to the provisions of section 7.03. In all other respects, Tenant’s Work shall be performed in accordance with the following provisions of this Section 3.04.

(b)Promptly after Delivery of Possession, Tenant shall commence the performance of Tenant’s Work and shall diligently prosecute Tenant’s Work to completion.

(c)Tenant shall perform all of Tenant’s Work in accordance with the provisions of subsections 7.03(b), (c), and (h), as if such subsections were applicable to Tenant’s Work.

Prior to doing any work relating to the installation of utility lines, feeders, conduits and waste lines (such work and installation are hereinafter referred to as “Additional Installations”), Tenant shall submit to Landlord for Landlord’s written approval (which approval shall not be unreasonably withheld, conditioned or delayed) detailed plans and specifications relating to such Additional Installations, including the area where work is to be performed. The Additional Installations including all equipment, labor, and materials shall be at Tenant’s sole cost and expense and shall be performed in conformity with said approved plans and specifications and with all applicable laws, rules, and regulations of governmental authorities and public utility companies having jurisdiction and with all rules and regulations of the Board of Fire Underwriters. All costs and expenses in connection with the repair, replacement, operation, and maintenance of such Additional Installations shall be borne solely by Tenant. All of the provisions of this Lease shall apply to the Additional Installations, including, by way of example, but not limited to, Tenant’s duty to comply with all laws, Tenant’s indemnification of Landlord for liability in regard thereto, and Tenant’s duty to carry insurance and Tenant’s duty to make repairs.

(d)If any governmental authority requires that a certificate of

occupancy be issued with respect to the Demised Premises, Tenant shall apply for, and obtain a certificate of occupancy and submit same to Landlord for inspection.

Section 4.01 Term:

The Term of this Lease shall commence on the earlier to occur of: (a) the ninetieth (90th) day next following Delivery of Possession; or (b) the date Tenant opens the Demised Premises for business. The Term shall expire on the date designated as Expiration Date in Article I. The date upon which the Term commences is referred to in this Lease as the “Commencement Date”.

Section 4.02 Short Form Lease:

Upon request of either party the other shall execute a document in recordable form setting forth the exact Commencement Date of the Term hereof. Contemporaneously with the execution hereof, the parties shall execute and deliver a short form lease or memorandum of lease in proper form for recording, setting forth such Commencement Date and any provision hereof other than Article V, Sections 1.04, 1.05, and 11.04. The party electing to record shall pay all recording fees and costs in connection with any such short form or memorandum

5

of lease. Neither Landlord nor Tenant shall record this Lease.

ARTICLE V. RENT, SECURITY, TAX CONTRIBUTIONS.

Section 5.01 Minimum Rent:

Tenant shall pay Minimum Rent to Landlord. Minimum Rent shall be payable without notice or demand. Minimum Rent shall be payable at the rates set forth in Article I. Minimum Rent shall be payable in equal monthly installments. Each monthly installment shall be due in advance. The first monthly installment shall be due on the Commencement Date. Each subsequent installment shall be due on the first day of each month during the Term. If the Commencement Date is a day other than the first day of the month, the first installment shall be one thirtieth of a normal monthly installment for each day during the period commencing with the Commencement Date up to and including the last day of that month. If the Expiration Date occurs on a day other than the last day of any month, Minimum Rent for the last month during the Term shall be pro rated in the same manner.

Section 5.02 Intentionally Omitted.

Section 5.03 Tax Contributions:

(a)In addition to all other charges Tenant is required to pay hereunder, Tenant shall pay “Tax Contributions” to Landlord.

(b)The following terms have the following meanings:

(i)“Tax Contributions” means Tenant’s Pro Rata Share of all Impositions, exclusive of interest and penalties attributable to Landlord’s delinquent payment of Impositions, if any;

(ii)“Impositions” means all taxes, assessments (special or otherwise, foreseen or unforeseen) and all other governmental charges assessed, levied or imposed against the Demised Premises, the Building and Land during any Tax Fiscal Year occurring wholly or partially within the Term. If any governmental authority imposes, assesses or levies tax on rent or any other tax upon Landlord as a substitute in whole or in part for real estate taxes or assessments, the substitute tax shall be deemed to be an Imposition.

(c)If any Tax Fiscal Year occurs partially within and without the Term, then, within a reasonable time after the Commencement Date or Expiration Date, Landlord and Tenant shall adjust Tax Contributions with respect to any such Tax Fiscal Year so that Tenant shall bear Tax Contributions which are attributable to the Term and Landlord shall bear the remainder thereof.

(d)Tenant shall pay Tenant’s Tax Contributions to Landlord as follows:

(i)If Landlord is required to pay monthly Impositions to any

Mortgagee Tenant shall pay monthly installments on account of Tax Contributions to Landlord. Installments shall be paid in the same manner and at the same time as Minimum Rent. Until the actual amount of Tax Contributions payable with respect to the first Tax Fiscal Year are actually determined, estimated monthly installments with respect to that Tax Fiscal Year shall be determined by Landlord in Landlord’s reasonable discretion. After Tax Contributions for the first Tax Fiscal Year are finally determined, each monthly installment shall be a fraction of Tenant’s Tax Contributions for the previous Tax Fiscal Year. The numerator of the fraction shall be one. The denominator of the fraction shall be the number of months in the previous Tax Fiscal Year. If Landlord is not required to pay monthly Impositions to any Mortgagee, then Tenant shall not be required to pay monthly Impositions and shall pay Tax Contributions within twenty (20) days of submission of a statement therefor but in no event earlier than thirty (30) days prior to the date that the Impositions are due and payable to the taxing authorities.

(ii) If the installments payable with respect to any Tax Fiscal Year shall exceed Tax Contributions for that Tax Fiscal Year, Landlord shall refund the difference to Tenant promptly. If the

6

installments payable with respect to any Tax Fiscal Year shall be less than Tax Contributions for that Tax Fiscal Year, Tenant shall reimburse Landlord for the difference promptly after Landlord renders a bill with respect thereto.

(e)Upon request, Landlord shall furnish Tenant with a copy of the current Imposition bill and a copy of the previous Imposition bill or evidence that such previous bill has been paid to the taxing authorities.

(f)Tenant shall not institute any proceeding with respect to the assessed valuation of the Demised Premises or any part thereof or the Impositions thereon, except as set forth below. If Landlord has not instituted such proceeding for any year or fiscal period and if at least forty-five (45) days prior to the last day for the institution thereof Tenant requests Landlord to institute such proceeding, Landlord may, within fifteen (15) days after such request, file with the appropriate municipal authority having jurisdiction thereover an application for reduction and correction of the tax assessment for such year or fiscal period, failing which, Tenant may institute such proceeding on behalf of Landlord and Landlord shall promptly furnish Tenant with copies of the notice of assessment and all other documents reasonably required by Tenant in order to prosecute such proceeding. If Landlord shall receive a refund of an Imposition for which Tenant has paid Tenant’s Pro Rata Share, Tenant shall receive Tenant’s Pro Rata Share thereof after deducting the costs, fees and expenses incurred in connection with obtaining such refund.

(g)“Tax Fiscal Year” means the applicable fiscal year(s) of the taxing authorities having jurisdiction over the Demised Premises.

(h)If an assessment is payable in installments and Landlord elects the installment method of payment, Impositions shall include only the installments that come due during the Term and the interest payable with respect to those installments. If an assessment is payable in installments and Landlord does not elect the installment method of payment, Impositions shall include only the installments that would have come due during the Term, and the interest that would have been payable with respect to those installments, had Landlord elected the installment method of payment, however, Tenant may elect to pay Tenant’s Pro Rata Share of such assessment in a lump sum.

Section 5.04 Payment of Rent:

(a)“Rent” means Minimum Rent and Tax Contributions.

(b)Rent shall be paid without notice, demand, counterclaim, offset, deduction, defense, or abatement, except as otherwise specifically set forth herein.

(c)All Rent payable under this Lease shall be payable at Landlord’s address as set forth in Section 19.04A or at such other address as Landlord shall designate by giving notice to Tenant.

(d)If Tenant shall fail to pay any Tax Contributions or any other charges payable hereunder whether or not same are called Rent or additional rent and if the failure results in “Default” (as hereinafter defined), Landlord shall have all remedies provided for in this Lease or at law in the case of nonpayment of Minimum Rent.

Tenant’s obligations (accruing during the Term) under Article V and Section 11.04 hereof, shall survive the expiration or sooner termination of this Lease.

ARTICLE VI. CONDITION OF DEMISED PREMISES AND SIGNS.

Section 6.01 No Representation, Etc.:

Landlord has made no representation, covenants or warranties with respect to the Demised Premises except as expressly set forth in this Lease.

7

Section 6.02 Mechanics’ Liens:

(a)If any mechanic’s or materialman’s lien is filed against the Demised Premises as a result of any additions, alterations, repairs, installations or improvements made by Tenant, or any other work or act of Tenant, Tenant shall discharge or bond same within twenty days from receipt of actual notice of the filing of the lien. If Tenant shall fail to discharge or bond the lien, Landlord may bond or pay the lien or claim for the account of Tenant without inquiring into the validity of the lien or claim.

(b)Tenant may contest any mechanics’ or other liens imposed against the Demised Premises (provided that Tenant shall have no responsibility with respect to liens arising from construction, repair or maintenance required of Landlord under this Lease); provided Tenant believes in good faith that such liens are not proper; and further provided that Tenant furnishes Landlord reasonable security to ensure payment and to prevent any sale, foreclosure or forfeiture of the Demised Premises by reason of such nonpayment. Tenant shall furnish to Landlord such security as Landlord may reasonably request pursuant to the foregoing sentence within (30) days of receiving a written request therefor. Upon a final determination of the validity of such lien or claim, Tenant shall promptly pay any judgment or decree rendered against Tenant or Landlord, including, without limitation, all costs and charges, and shall cause such lien to be released of record, all without cost to Landlord.

Section 6.03 Signs:

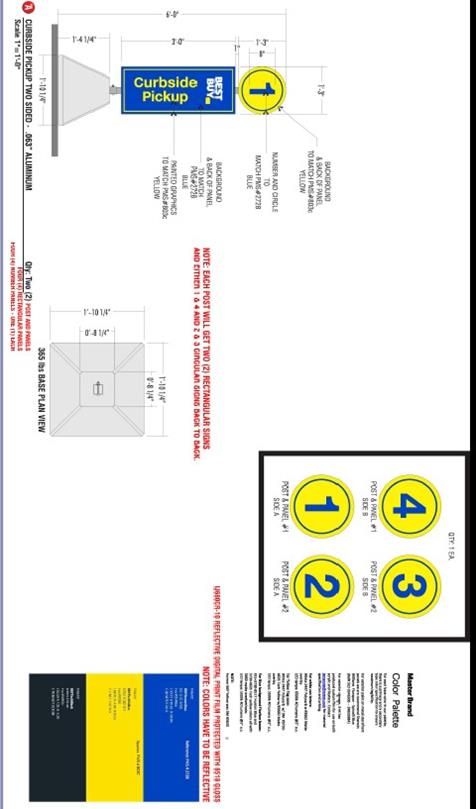

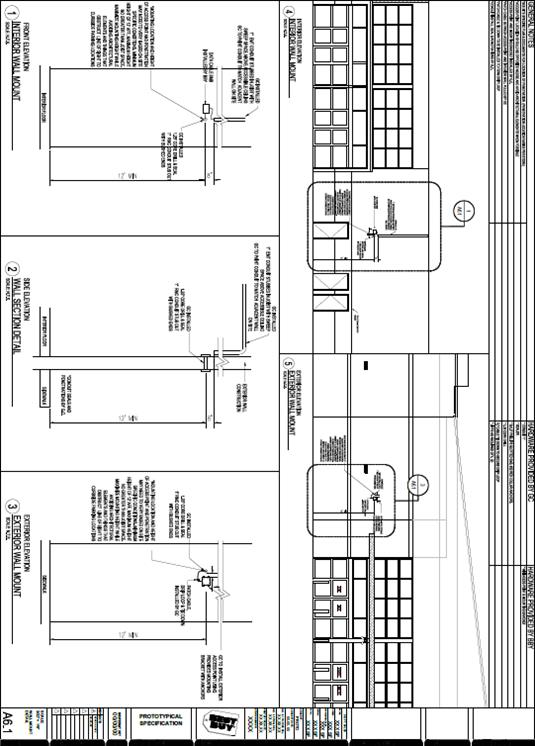

(a)Tenant shall have the right to install and maintain signs affixed to the exterior of the Demised Premises subject to (i) the written approval of Landlord as to dimensions, material, content, location and design, which approval shall not be unreasonably withheld, delayed or conditioned, (ii) applicable legal requirements, (iii) Insurance Requirements. Tenant shall obtain and pay for all required permits and licenses relating to such signs. Copies of all such permits and licenses shall be delivered to Landlord upon request. Landlord shall, at Tenant’s cost, reasonably cooperate with Tenant in obtaining all required permits, licenses and approvals.

(b)Tenant has submitted to Landlord prototype sign plans, which plans are annexed hereto as Exhibit C (“Tenant’s Sign Plans”) and which includes prototypes of the sign(s) Tenant desires to place on the Building and on the “Pylon” (as hereinafter defined). Landlord agrees that Tenant may install a sign(s) on the front of the Demised Premises and on the Pylon, substantially similar to the signs shown on Tenant’s Sign Plans. In addition, Best Buy Stores, L.P. or any assignee pursuant to Section 10.01(e) may, without Landlord’s approval as provided in Section 6.03(a)(i), but subject to the other terms and conditions of Section 6.03(a), install its prototypical sign(s) on the exterior walls of the Building in the locations specified in Tenant’s Sign Plans, provided that any such sign is comprised of individually lighted letters and not a back lighted box

sign.

(c)Tenant shall not have the right to maintain or install any other signs in or at the Shopping Center or visible from the outside of the Demised Premises (other than as set forth in (a) and (b) above or in (f) below), other than neatly lettered professionally made signs, stickers or decals located inside the Demised Premises.

(d)If necessary in order to make repairs, alterations or improvements in or to the Demised Premises or the Monument(s), which Landlord is obligated or has the right to perform, Landlord shall have the right to remove any of Tenant’s signs, provided, however, that Landlord shall, at its expense, promptly replace any such sign promptly after such work is completed by Landlord. Landlord shall proceed with due diligence in the performance of any such work.

(e)Tenant may not install signs, lamps or other illumination devices in or upon the Demised Premises if the lamps, signs or devices flash or go on and off intermittently.

8

(f)Tenant shall have the right to install its sign on the Monument, as shown on Exhibit A, (“Monument”), subject to legal requirements, and in accordance with the following provisions:

(i)Tenant may install its sign in the sign panel previously used by Toys “R” Us or in a new sign panel of the same size, position and dimensions as the sign panel previously used by Toys “R” Us, as shown on Exhibit C.

(ii)Tenant’s sign shall be subject to (w) the written approval of Landlord as to dimensions, material, content, location and design, provided such approval shall not be unreasonably delayed, withheld or conditioned, (x) the requirements and conditions of the REA and the Operating Agreement (as hereinafter defined), (y) applicable legal requirements, and (z) Insurance Requirements. Tenant shall obtain and pay for all required permits and licenses relating to such sign. Copies of all such permits and licenses shall be delivered to Landlord within a reasonable time after they are issued. Landlord shall, at Tenant’s cost, reasonably cooperate with Tenant in obtaining all required permits, licenses and approvals.

(iii)If Tenant installs a sign on a Monument, Tenant shall be solely responsible for the cost of repairing, maintaining, replacing, altering and furnishing electric current to the Monument.

(iv)Tenant shall, at its sole cost and expense, keep its sign located on the Monument in good order and repair.

Section 6.04 Insurance Covering Tenant’s Work:

Tenant shall not make any alterations, repairs or installations, or perform Tenant’s Work or any other work to or on the Demised Premises unless prior to the commencement of such work Tenant shall obtain or cause its contractor(s) to obtain (and during the performance of such work keep in force) builders risk, public liability and workmen’s compensation insurance to cover every contractor to be employed. Such policies shall be non cancelable without ten days notice to Landlord. The policies shall be in amounts and shall be issued by companies licensed to do business in the State in which the Demised Premises are located and reasonably satisfactory to Landlord and shall name Landlord and any Mortgagee as additional insureds. Prior to the commencement of such work, Tenant shall deliver duplicate originals or certificates of such insurance policies to Landlord.

ARTICLE VII. REPAIRS. ALTERATIONS, COMPLIANCE, SURRENDER.

Section 7.01 Repairs by Landlord:

(a)Landlord shall, at its cost and expense, for a one (1) year period commencing on the Commencement Date, reasonably repair and maintain the existing HVAC system in the Demised Premises.

(b)Landlord shall replace the roof of the Demised Premises, if so required, during the Term. Landlord shall be under no duty to inspect the Demised Premises to determine if such replacement is needed and Tenant shall undertake such inspection. Landlord’s obligation to replace the roof shall arise only after Tenant advises Landlord in writing that such replacement is required, together with reasonable supporting documentation. Tenant shall be obligated to pay Landlord for the costs incurred by Landlord in replacing the roof in equal monthly installments on the first (1st) day of each month commencing on the first (1st) day of the month following such replacement at a rate equal to one-twelfth (1/12th) of the annual amortization of such cost (amortized on a straight-line basis over a period of seven (7) years).

9

Section 7.02 Repairs and Maintenance by Tenant:

(a)Except for repairs Landlord is specifically obligated to make or cause to be made hereunder, Tenant shall make all repairs to the Demised Premises and the Common Area necessary or desirable to keep the Demised Premises and the Common Area in good order and repair and in a safe, dry and tenantable condition, ordinary wear and tear excepted. Without limiting the generality of the foregoing, Tenant shall be specifically required to make repairs (a) to that portion of any pipes, lines, ducts, wires, or conduits that service Tenant and are contained within the Demised Premises or that service the Demised Premises exclusively and are located outside of the Demised Premises; (b) to windows, plate glass, doors, and any fixtures or appurtenances composed of glass; (c) to Tenant’s sign(s), including any sign installed on a Monument, (d) after the one year anniversary of the Commencement Date, to any heating or air conditioning equipment installed in or servicing the Demised Premises; and (e) to the Demised Premises or the Building when repairs to the same are necessitated by any act or omission of Tenant or Tenant’s Agents, or the failure of Tenant to perform its obligations under this Lease. Tenant shall keep the Demised Premises in a reasonably clean and sanitary condition, reasonably free from vermin and escaping offensive odors. In addition, Tenant shall comply with the maintenance and repair obligations and conditions as set forth in Article 20 of the “Operating Agreement” (as hereinafter defined).

(b)Tenant shall keep the Parking Area properly paved and in good order and repair throughout the Term, in a commercially reasonable manner consistent with the operation and management of first class strip shopping centers in the state where the Demised Premises is located. Tenant shall keep the Parking Area properly drained and shall provide painted stripes to designate parking spaces. Tenant will remove or cause to be removed accumulated snow and ice, if any, (in accordance with sound shopping center management practice consistent with the operation and management of similar class strip shopping centers in the state where the Demised Premises is located) from the Parking Area and Land. Tenant may deposit accumulated snow on portions of the Land as may be necessary under the circumstances; provided that such ice and snow shall only be deposited in portions of the Land not adjacent to the Demised Premises which will be selected with a view to minimizing any disruption with the parking and access roadways on the Land. If any ice cannot be removed with reasonable effort on the part of Tenant, it will be sufficient for Tenant to spread sand or other abrasive substance over the ice. Tenant shall keep the Parking Area illuminated from sunset until at least the earlier to occur of 10:00 p.m. or one-half hour after the Demised Premises closes for business from Monday through Sunday, except for legal holidays when the Demised Premises are closed.

Section 7.03 Approval by Landlord of Repairs and Alterations:

After completion of Tenant’s Work, Tenant may make repairs and alterations to the Demised Premises, subject to the following provisions:

(a)such alterations or repairs shall not reduce the fair market value of the Building below its value immediately before such alteration or addition;

(b)such alterations or repairs shall be effected with due diligence and in good and workmanlike manner in accordance with all applicable legal requirements and Insurance Requirements;

(c)such alterations or repairs shall be promptly and fully paid for by

Tenant;

(d)any alterations or repairs to the plumbing, mechanical, electrical, sewerage, sprinkler

10

or HVAC system which adversely affect the Building or which substantially change the capacity of any such system, shall be done in accordance with plans, specifications approved by Landlord, which approval shall not be unreasonably withheld, delayed or conditioned provided that Tenant remedies the adverse effect of such alteration or repair;

(e)Tenant shall not make any major structural alterations without obtaining Landlord’s prior written consent, which consent shall not be unreasonably withheld, delayed or conditioned provided: (i) such alteration is architecturally compatible with the Building; and (ii) such alteration neither changes the size of the floor area of the Demised Premises, changes the height of the Building, results in there not being store premises within the Demised Premises consisting of at least 20,000 square feet of floor area (exclusive of any mezzanine), nor result in there being more than two (2) separate premises within the Demised Premises;

(f)Tenant may perform any other non structural interior repairs or alterations within the Demised Premises without obtaining Landlord’s consent;

(g)Tenant shall, within a reasonable time after completion of any alteration or repair, which required the preparation of plans and specifications, furnish Landlord with a set of “as built” plans and specifications therefor.

(h)Notwithstanding anything to the contrary contained herein, Tenant may not construct a mezzanine in the Demised Premises without obtaining Landlord’s consent.

Section 7.04 Compliance:

(a)Tenant shall observe and comply promptly with all present and future legal requirements and Insurance Requirements relating to or affecting the Demised Premises, the Building, the Common Area or any sign of Tenant, or the use and occupancy thereof, or any appurtenance thereto, and any construction, installations or equipment belonging to or installed by Tenant anywhere in the Shopping Center and shall comply with same relating to any other portion of the Shopping Center if such compliance is necessitated due to any acts or omissions of Tenant, including, without limitation, Tenant’s use or manner of use of the Demised Premises [“Tenant’s Requirement(s)”]. If such compliance requires the making of exterior or structural alterations or repairs, Tenant shall not commence such alterations or repairs unless and until tenant has submitted plans and specifications for such work to Landlord, and Tenant has obtained the approval thereof from Landlord and, if required, from any Mortgagee. Such approval by Landlord and the Mortgagee shall not be unreasonably withheld or delayed.

(b)Tenant may, at its expense, contest by appropriate proceedings prosecuted diligently and in good faith, the validity or applicability of Tenant’s Requirement(s), provided that:

(i)Landlord shall not be subject to any criminal penalty or prosecution for a crime nor shall the Building or any part thereof be subject to being condemned, closed or vacated by reason of non compliance or otherwise by reason of such contest;

(ii)Tenant shall defend, indemnify and hold harmless Landlord against all liability, loss or damage which Landlord shall suffer by reason of such non compliance or contest, including reasonable attorneys’ fees and other expenses reasonably incurred by Landlord;

(iii)such non compliance or contest shall not constitute or result in any violation of any Mortgage or Master Lease affecting the Building;

11

(iv)Tenant shall keep Landlord reasonably advised as to the status of such proceedings; and

(v)such non compliance or contest shall not result in a lien being filed against the Building, unless a bond is posted in satisfaction of such lien in an amount and with a surety reasonably acceptable to Landlord.

Tenant need not comply with any such Tenant’s Requirement(s) so long as Tenant is contesting the validity thereof and the provisions of subparagraphs (i) through (v) are being met.

Without limiting the application of the foregoing, Landlord shall be deemed subject to prosecution for a crime within the meaning hereof, if Landlord, or any officer of Landlord individually, is charged with a crime of any kind or degree whatever, whether by service of a summons or otherwise, unless such charge is withdrawn before Landlord or such officer (as the case may be) is required to plead or answer thereto.

(c)(i) Tenant shall not use, install or dispose of hazardous wastes or

other hazardous materials, including, without limitation, asbestos (individually and collectively “Hazardous Substance(s)”), at, on or near the Building or Land, subject, however, to the provisions of subsection 7.04(c)(iii).

(ii)If any Hazardous Substance(s) is found at, on or near the Building or Land, Tenant shall promptly, at its sole cost and expense, remove and/or treat the same, as required by law and pay any fines or penalties imposed by any governmental authority in connection therewith.

(iii)Notwithstanding the provisions of subsection 7.04(c)(i), Tenant may use in the ordinary course of a retail business cleaning solvents and similar products and sell products at the Demised Premises which are sold in a typical first class retail electronics store and which may be classified as a Hazardous Substance(s), provided in either case that same are stored, used and sold in accordance with legal requirements and provided that Tenant complies with the provisions of subsection 7.04(c)(ii).

(d)Tenant shall fully and faithfully comply with the terms and conditions of the REA and that certain Operating Agreement dated January 31, 1980 and recorded March 5, 1980 in Book 1247 at Page 110 between General Growth Properties; J.C. Penney Properties, Inc. and Dayton-Hudson Corporation, d/b/a Target Stores, as amended by First Amendment of Operating Agreement dated as of April 29, 1981 and recorded June 15, 1981 in Book 1318 at Page 580; Second Amendment of Operating Agreement dated as of June 1, 1982 and recorded October 6, 1982 in Book 1394 at Page 237; Third Amendment of Operating Agreement dated as of September 1, 1982 and recorded on December 23, 1982 in Book 1406 at Page 723; Fourth Amendment of Operating Agreement dated as of February 1, 1984 and recorded September 5, 1984 in Book 1503 at Page 592; Fifth Amendment of Operating Agreement dated as of December 30, 1993 and recorded January 10, 1997 in Book 2293 at Page 603; and as modified by First Amendment to Supplemental Agreement dated as of January 12, 1982 and recorded March 8, 1982 in Book 1360 at Page 483 between General Growth Properties and J.C. Penney Properties, Inc. (collectively, the “Operating Agreement”), and any supplemental or maintenance agreements relating thereto. Tenant shall not do or cause to be done or suffer or permit any act to be done which would or might cause the REA and/or the Operating Agreement, or the rights of Landlord under the REA and/or Operating Agreement, to be endangered, canceled, terminated, forfeited or surrendered, or which would or might cause Landlord to be in default thereunder or liable for any damage, claim or penalty. If there is any conflict between the provisions of this Lease and the provisions of the REA and/or the Operating Agreement which would permit Tenant to do or cause to be done or suffer or permit any act or thing to be done which is prohibited by the REA and/or the Operating Agreement then the provisions of the REA and/or the Operating

12

Agreement shall prevail.

Section 7.05 Electrical Lines:

If the Tenant installs any electrical equipment that overloads the lines in the Building or the Shopping Center, Landlord may require Tenant to make whatever changes to such lines as may be necessary to render the lines in good order and repair and in compliance with all Insurance Requirements and applicable legal requirements.

Section 7.06 Emergency Repairs:

If, in an emergency, it shall become necessary to make promptly any repairs or replacements required to be made by Tenant, Landlord or any Mortgagee, may, upon reasonable notice to Tenant under the circumstances, enter the Demised Premises and proceed to have such repairs or replacements made and pay the cost of such repairs or replacements. Within thirty (30) days after Landlord renders a bill for such repairs or replacements, Tenant shall reimburse Landlord for the reasonable cost of making such repairs. Landlord agrees to use due diligence and reasonable efforts to make all such repairs required of Landlord in a timely and non disruptive manner.

Section 7.07 Surrender of Premises:

On the Expiration Date, Tenant shall quit and surrender the Demised Premises broom clean, and in good condition and repair, reasonable wear and tear and damage due to fire or other casualty or condemnation excepted, together with all alterations, fixtures, installations, additions and improvements which may have been made in or attached on or to the Demised Premises, provided, however, Tenant shall remove its trade fixtures, personal property and readily removable decorative installations and improvements installed by Tenant, provided Tenant promptly repairs any damage caused by such removal. Any personal property of Tenant or any subtenant or occupant which shall remain in or on the Demised Premises after the termination of this Lease and the removal of Tenant or such subtenant from the Demised Premises, may, at the option of Landlord and without notice, be deemed to have been abandoned by Tenant or such subtenant or occupant and may either be retained by Landlord as its property or be disposed of, without accountability, in such manner as Landlord may see fit, or if Landlord shall give written notice to Tenant to such effect, such property shall be removed by Tenant, at Tenant’s cost and expense; and Landlord shall not be responsible for any loss or damage occurring to any such property owned by Tenant or any subtenant or occupant. Tenant’s obligations under this Section shall survive the Expiration Date.

ARTICLE VIII SERVICE AND UTILITIES.

Section 8.01 Electricity:

Tenant shall install an electric meter to measure electricity consumed at the Demised Premises and shall perform such other work as shall be necessary so that consumption of electricity at the Demised Premises shall be measured separately. Tenant shall make its own arrangements with the utility company supplying electricity for that service. Commencing at Delivery of Possession, Tenant shall pay for all electrical service and charges relating to the Demised Premises and Tenant’s sign, including, but not limited to, transformer, panel and wiring maintenance; upgrades; and code changes or requirements.

Section 8.02 Gas Service:

If Gas Service is available to the Demised Premises and if Tenant shall desire to use such service,

13

Tenant shall install a gas meter to measure gas consumed at the Demised Premises and shall perform such other work as shall be necessary so that consumption of gas at the Demised Premises shall be measured separately. Tenant shall make its own arrangements with the utility company supplying gas for that service. Commencing at Delivery of Possession, Tenant shall pay for all gas service and charges relating to the Demised Premises.

Section 8.03 Water:

Tenant shall install a water meter at Tenant’s expense to measure water consumed at the Demised Premises and shall make its own arrangements with the utility company supplying water and/or sewer service for that service. Commencing at Delivery of Possession, Tenant shall pay for water and sewer or water rent, charge, tax or levy.

Section 8.04 Heat, Hot Water, Air Conditioning:

Landlord shall not be required to supply heat, hot water or air conditioning to the Demised Premises. Tenant shall supply its own requirements of heat, hot water and air conditioning.

ARTICLE IX. USE AND OPERATION.

Section 9.01 Use:

(a)Tenant shall use the Demised Premises as a first class retail electronics store, and for no other purpose except as otherwise specifically set forth below. The foregoing shall not constitute an obligation or a covenant on the part of Tenant to continuously operate or conduct any business whatsoever in the Demised Premises during the Term or any Renewal Terms. Tenant, upon prior written notice to Landlord, may change the use of the Demised Premises to any “Lawful Retail Use” (as hereinafter defined) provided that at least one (1) store unit of at least 20,000 square feet of floor area (exclusive of any mezzanine) remains in operation and that there are not more than two (2) separate premises in operation within the Demised Premises, and for no other purpose. No portion of the Demised Premises may, at any time during the Term, be used as a supermarket.

(b)If Tenant fails to open for business in the Demised Premises, Landlord shall have the right to terminate this Lease by written notice to Tenant thirty (30) days prior to the date upon which such failure to open would trigger any right to recapture, if any, in the REA and/or Operating Agreement.

(c)The term “Lawful Retail Use”, as used in this Lease, shall be construed broadly to mean any lawful sales of merchandise or services, whether at retail, wholesale or discount, which are typically found in similar class strip shopping centers in the Grand Junction metropolitan area.

Section 9.02 Landlord’s Additional Right of Recapture:

(a)If at any time during the Term, (1) Tenant gives Landlord notice of Tenant’s intention to cease business operations in the Demised Premises (the “Go Dark Notice”), or (2) all or substantially all of the Demised Premises is not open to the public for business for a period of six (6) consecutive months for reasons other than remodeling, damage and destruction, eminent domain or a change in the occupancy of the Demised Premises resulting from an assignment or sublease entered into pursuant to Article X (provided that such assignee or sublessee must reopen the Demised Premises for business by the end of the tenth (10th) consecutive month), Landlord shall have the right to recapture the Demised Premises in accordance with the provisions of the immediately succeeding paragraph.

(b)At any time after either receipt of the Go Dark Notice or the expiration of the six (6)

14

month period referred to in the immediately preceding paragraph, Landlord may, but shall be under no obligation to give to Tenant, a notice (hereinafter “Notice of Recapture”), which Notice of Recapture shall be given, if at all, within thirty (30) days thereafter. Landlord, in its Notice of Recapture, shall set forth a date not sooner than thirty (30) days (but, in no event less than the minimum number of days to permit Tenant to comply with applicable laws concerning cessation of operations at the Demised Premises) nor more than ninety (90) days after such notice, as the date for the termination of this Lease, and upon such date, this Lease shall terminate as if such date were the date originally set forth in this Lease as the Expiration Date of the Term, and upon such date this Lease shall be null and void and of no further force or effect, except for accrued liabilities. Notwithstanding the foregoing, if prior to the termination date set forth in the Notice of Recapture the conditions set forth in the immediately preceding paragraph do not exist and if at least 50% of the Demised Premises are being used in accordance with this Lease and are opened to the public staffed, fixtured and merchandised in accordance with sound business judgment, then Landlord’s Notice of Recapture shall be automatically revoked.

(c)Landlord’s rights under this Section shall be continuing rights and shall not be exhausted by any number of failures to exercise. If Landlord has not sent a Notice of Recapture to Tenant, Landlord’s rights to recapture shall continue as long as the condition giving rise to such rights exists and Landlord shall have the right to recapture the Demised Premises as provided in this Section 9.02(b).

Section 9.03 Store Operations:

(a)Intentionally Omitted.

(b)Keeping Demised Premises Clean: Tenant shall keep the Demised Premises, including exterior and interior portions of all windows, doors and all other glass, in neat and clean condition.

(c)Paving Taxes: Tenant shall pay before delinquency any and all taxes, assessments and public charges levied, assessed or imposed upon Tenant’s business or upon Tenant’s fixtures, furnishings or equipment in the Demised Premises.

(d)Paving License Fees: Tenant shall pay promptly all license fees, permit fees and charges of a similar nature for the conduct by Tenant or any subtenant of any business or undertaking authorized hereunder to be conducted in the Demised Premises.

(e)Exclusive Delivery Facilities and Sidewalks: Tenant shall keep and maintain in good order, condition and repair any loading platform, truck dock or truck maneuvering space which is used by Tenant and to which Tenant has the right of exclusive use. Tenant shall remove snow and ice from the sidewalk(s) adjacent to the Demised Premises and spread sand or other abrasive substances thereon as conditions require.

(f)Garbage: Tenant agrees not to permit the accumulation (unless in concealed metal containers) or burning of any rubbish or garbage in, on or about any part of the Shopping Center. Tenant shall cause and pay for all rubbish and garbage to be collected and disposed of from the Demised Premises. Tenant shall keep the sidewalk(s) and curbs adjacent to the Demised Premises free of debris.

(g)Rules and Regulations: Tenant shall observe all reasonable, uniform and non discriminatory rules and regulations established by Landlord from time to time for the Building or the Shopping Center, provided Tenant shall be given at least five days notice thereof, and provided same do not diminish Tenant’s rights or increase Tenant’s costs hereunder.

(h)Restrictive Covenants: Tenant agrees that it will comply with and observe all restrictive covenants of which Tenant has notice and which presently affect or are applicable to the

15

Shopping Center, the Building, the Demised Premises and the Common Area, provided same do not prohibit or materially interfere with Tenant’s use of the Demised Premises or the Common Areas, in accordance with the provisions of this Lease or otherwise materially adversely affect Tenant’s rights under this Lease or increase Tenant’s obligations, subject, however, to the provisions of Subsection 9.01(a). As of the date hereof, the restrictions affecting the Demised Premises are set forth on Exhibit F.

(i)Prohibited Uses: The Demised Premises may not be used for any of the following uses: any pornographic or obscene purposes (excluding games, audio cassettes or discs and videos typically sold in a first-class consumer electronics store), any commercial sex establishment, any pornographic, obscene, nude or semi-nude performances, modeling, obscene materials, activities or sexual conduct.

Section 9.04 Restriction on Tenant’s Activities at Shopping Center:

(a)Sidewalk Use: Tenant shall not use the sidewalk adjacent to or any other space outside the Demised Premises for display, sale or any other similar undertaking without the prior consent of Landlord in each instance.

(b)Loud Speaker Use: Tenant shall not use any advertising medium which may be heard outside the Demised Premises.

(c)Plumbing Facility Use: Tenant shall not use the plumbing facilities of the Demised Premises for any purpose other than the purpose for which they are intended. Accordingly, Tenant may not dispose of any substances there which may clog, erode or damage the pipelines and conduits of the Building or Shopping Center.

(d)Floor Load: Tenant shall not place a load on any floor exceeding the floor load per square foot which such floor was designed to carry. Tenant shall not install, operate or maintain any heavy item of equipment in the Demised Premises except in such manner as to achieve a proper distribution of weight.

(e)Exterior or Roof: Tenant shall not use for any purpose all or any portion of the roof (other than for HVAC equipment and a satellite communications system) or exterior walls (other than for permitted signs) of the Demised Premises.

(f)Freight Handling Equipment: Tenant shall not use any non rubber wheeled forklift truck, tow truck or any other non rubber wheeled machine for handling freight except as may be approved by Landlord.

(g)Mezzanines: Tenant may not use any mezzanine located within the Demised Premises for selling purposes (any such mezzanine shall be used solely for storage, preparation of merchandise and clerical purposes).

(h)Prohibited Uses:

(i)Tenant and its successors and assigns shall not use or sublease or permit the use of the Demised Premises, or any portion thereof, for any operation, activity or business that: (a) creates strong, unusual or offensive odors, fumes, dust or vapors; (b) is a public or private nuisance; (c) emits noise or sounds which are heard outside the Demised Premises or are objectionable due to intermittence, beat, frequency, shrillness or loudness; (d) creates unusual fire, explosive or other hazards; (e) involves the handling, storage, sale or installation of Hazardous Materials; or (f) involves the sale of alcoholic beverages.

(ii)Tenant and its successors and assigns shall not operate, sublease or permit the Demised Premises, or any portion thereof, to be used primarily as a modem toy store, or a modem babies’,

16

infant’s juvenile’s and children’s specialty store, provided, however, the foregoing restriction shall terminate if Landlord and/or its parent or any affiliate, subsidiary, related entity, Mortgagee or successor-in-interest by merger or consolidation is no longer engaged in the retail business of operating modem toy stores or modem baby specialty stores, if applicable.

(iii)Tenant and its successors and assigns shall not operate, sublease or permit the Demised Premises, or any portion thereof, to be used as or for any of the following uses or purposes: cemetery; mortuary; so-called “head-shop”; the dumping or disposing of garbage or refuse; video or other type of gameroom or arcade; carnival; off-track betting parlor; pawn shop; business selling so-called “second-hand goods” or governmental “surplus” goods; junk yard; flea market; recycling facility or stockyard; any fire sale, bankruptcy sale or auction house operation, unless pursuant to an order of a court of competent jurisdiction; motor vehicle or boat dealership, repair shop (including lubrication and/or service center), body and fender shop, car wash facility, or motor vehicle or boat storage facility; theater (including, without limitation, a movie theater), auditorium, sports or other entertainment viewing facility (whether live, film, audio/visual or video); discotheque, dance hall, bar; bowling alley; skating rink; billiard parlor; health spa or exercise facility; massage parlor; dry cleaning or laundry plant (except as to an establishment which receives and dispenses items for launder and/or dry cleaning but the processing of which such items is done elsewhere); industrial or manufacturing uses; catering hall; bingo parlor; factory uses; any business servicing motor vehicles or selling gasoline or diesel fuel at retail or wholesale and services relating thereto, including, without limitation, any quick lube oil change services, or any other vehicle mechanical service or repair facility (but the installation and repair of electronics in motor vehicles shall be permitted as an incidental use); office uses (including governmental services offices, such as, but without limitation, motor vehicle or social services offices, but, excluding so-called “back office” space used in connection with a permitted use hereunder); hotel/motel uses; warehousing (excluding any warehousing incidental to the operation of permitted retail uses being conducted thereat); training or educational facility or house of worship; or a recreation and fitness facility, whether providing exercise, recreational, educational, entertainment or fitness activities, or any combination of the foregoing. “Training or educational facility” shall mean a beauty school, barber college, reading room, place of instruction or any other activity catering primarily to students or trainees as opposed to customers.

(iv)Tenant and its successors and assigns shall not operate, sublease or permit the Demised Premises, or any portion thereof, to be used or occupied as an adult book store or a store selling or exhibiting pornographic materials (excluding games, audio cassettes or discs and videos typically sold in a first class consumer electronics store). As used herein, “an adult book store or store selling or exhibiting pornographic materials” shall mean a store displaying for sale or exhibition books, magazines or other publications containing any combination of photographs, drawings or sketches of a sexual nature, which are not primarily scientific or educational, or a store offering for exhibition, sale or rental video cassettes or other medium capable of projecting, transmitting or reproducing, independently or in conjunction with another device, machine or equipment, an image or series of images, the content of which has been rated “X” or “NC-17” (or any succeeding like rating) by the Motion Picture Rating Association, or any successor thereto (“X-Rated Videos”). Further, Tenant and its successors and assigns shall not operate, sublease or permit the Demised Premises, or any portion thereof, to be used or occupied for any obscene, nude or semi-nude live performances, nude modeling, rap sessions, or as a so-called rubber goods shop, or as a sex club of any sort, or as a massage parlor.

(v)Tenant and its successors and assigns shall not operate, sublease or permit the Demised Premises or any portion thereof to be used as or for any uses or purposes in violation of the REA.

Section 9.05 Insurance Rate:

Tenant agrees to comply with all Insurance Requirements of which Tenant has notice relating to or affecting the Demised Premises or Tenant’s activities at the Building, Land or Shopping Center. If the insurance

17

rates applicable to the Building, Land or Shopping Center are raised as a result of, or in connection with, (x) any failure by Tenant to comply with such Insurance Requirements, or (y) the manner of use of the Demised Premises, then provided Tenant receives a statement from Landlord or the insurance carrier setting forth the reason therefor, Tenant shall pay to Landlord on demand, the portion of the premiums for all insurance policies applicable to the Building, Land and the Shopping Center as shall be attributable to the higher rates or cease the activity which caused the higher rates. For the purposes of this Section, any finding of Landlord’s insurance carrier shall be deemed to be conclusive unless Tenant’s insurance consultant disagrees with the finding of Landlord’s insurance carrier by notice to Landlord within fifteen (15) days after Tenant receives said statement from Landlord’s insurance carrier. If Tenant’s insurance consultant notifies Landlord that it disagrees with the opinion of Landlord’s insurance carrier within said fifteen (15) day period, and if said insurance carrier and consultant cannot come to an agreement within fifteen (15) days thereafter, they shall select a third impartial consultant whose decision shall be binding on the parties. If Landlord’s insurance carrier and Tenant’s consultant cannot agree on the choice of the third impartial consultant either party shall have the right to apply to the county court of the county in which the Demised Premises is located to select a third impartial consultant.

Section 9,06 Intentionally Omitted.

Section 9.07 Illegal Purposes:

Tenant shall not use the Demised Premises for any illegal trade, manufacture, or other business, or any other illegal purpose.

Section 9.08 Satellite Dish:

Provided Tenant, at its sole cost and expense, has applied for and received any and all permits and licenses which may be required from the applicable governmental authorities having jurisdiction, Tenant may install satellite dishes or other similar type devices used for the transmission and reception of wireless communication signals (collectively, the “Satellite Dish”) on the roof of the Building, subject to and in accordance with the following conditions:

(a) Prior to doing any work relating to the installation of the Satellite Dish, Tenant shall submit to Landlord for Landlord’s written approval (which approval shall not be unreasonably withheld or delayed) detailed plans and specifications relating to such work, including the areas where work is to be performed. All work, repairs or replacements, performed or required in connection with Tenant’s use of the Satellite Dish, including all equipment, labor and materials, shall be at Tenant’s sole cost and expense and shall be performed in conformity with said approved plans and specifications and with all applicable laws, rules and regulations of governmental authorities and insurance companies having jurisdiction;

(b)The Satellite Dish shall be reasonably screened from public view;

(c)All costs and expenses in connection with the repair, operation and maintenance of the Satellite Dish shall be borne solely by Tenant, including, but not limited to, repairs to the roof of the Building caused by Tenant’s installation and use of the Satellite Dish;

(d)All of the provisions of this Lease shall apply to the Satellite Dish, including, by way of example, but not limited to, Tenant’s duty to comply with all laws, Tenant’s indemnification of Landlord for liability in regard thereto, Tenant’s duty to carry insurance, and Tenant’s duty to avoid a violation of any roof bond;

(e)If at any time after Tenant’s installation of the Satellite Dish, for any reason whatsoever, the governmental permits and/or licenses for the Satellite Dish shall be revoked or any governmental authorities having jurisdiction shall prohibit Tenant’s use thereof, this Lease shall not be affected thereby and Tenant shall

18

immediately, at its own cost, remove same and repair any damage caused thereby; and

(f)Tenant shall not lease, license or concession or allow anyone to use any portion of the roof or Satellite Dish for any purposes whatsoever, except that Best Buy Stores, L.P., or a transferee pursuant to Section 10.01(e) may permit the Satellite Dish to be used by third parties conducting business within the Demised Premises solely in connection with the services provided or products sold at Demised Premises.

ARTICLE X. TRANSFER OF INTEREST, PRIORITY OF LIEN.

Section 10.01 Assignment, Subletting, etc.:

(a) Tenant shall not sublet the Demised Premises or any part thereof, or assign, mortgage or hypothecate, or otherwise encumber this Lease or any interest therein nor grant concessions or licenses for the occupancy of the Demised Premises or any part thereof, without Landlord’s prior written consent, which consent shall not be unreasonably conditioned, delayed or withheld. Any attempted transfer, assignment or subletting shall be void and confer no rights upon any third person. No assignment or subletting shall relieve Tenant of any obligations herein. The consent by Landlord to any transfer, assignment or subletting shall not be deemed to be a waiver on the part of Landlord of any prohibition against any future transfer, assignment or subletting without Landlord’s prior consent. No transfer, or subletting shall be effective unless and until (x) Tenant gives notice thereof to Landlord, and (y) the transferee, assignee or sublessee shall deliver to Landlord (1) a written agreement in the form and substance satisfactory to Landlord pursuant to which the transferee, or assignee assumes all of the obligations and liabilities of Tenant under this Lease, and (2) a copy of the assignment agreement or sublease. Tenant may not enter into any lease, sublease, license, concession or other agreement for use, occupancy or utilization of space in the Demised Premises which provides for a rental or other payment for such use, occupancy or utilization based in whole or in part on the net income or profits derived by any person from the property leased, occupied or utilized, or which would require the payment of any consideration which would not fall within the definition of “rents from real property” as that term is defined in Section 856(d) of the Internal Revenue Code of 1986, as amended.

(b)(i) In the event that Tenant shall desire Landlord’s consent to the

subletting of all or a portion of the Demised Premises or the assignment of this Lease, Tenant shall give Landlord sixty (60) days prior written notice thereof (“Tenant’s Notice”). Such notice shall be deemed to be an offer by Tenant to assign this Lease to Landlord in the event Tenant shall desire Landlord’s consent to sublet all of the Demised Premises or to assign this Lease and shall be deemed to be an offer to surrender the portion of the Demised Premises in question if Tenant desires Landlord’s consent to sublet a portion of the Demised Premises. In the event Landlord wishes to accept said offer, Landlord shall give Tenant notice thereof within one hundred twenty (120) days of Landlord’s receipt of the Tenant’s Notice (“Landlord’s Notice”), in which event the assignment or surrender of a portion of the Demised Premises to Landlord shall become effective on the date specified in Landlord’s Notice, which date shall be not more than one hundred eighty (180) days after the date of Landlord’s Notice, and Tenant shall vacate the Demised Premises or portion thereof in accordance with Section 7.07 by such date (but, in no event, less than the minimum number of days to permit Tenant to comply with applicable laws concerning cessation of operations at the Demised Premises); provided, however, if Landlord’s Notice specifies a date less than one hundred eighty (180) days from the date of Tenant’s Notice, Tenant shall, on the date which is two (2) business days prior to the date set forth in Landlord’s Notice, pay Landlord in a lump sum an amount equal to the Recapture Rent (as hereinafter defined). The term “Recapture Rent” means the difference between (1) the aggregate Rent hereunder for the period commencing on the date of receipt of Tenant’s Notice and ending 180 days thereafter, and (2) any Rent actually paid to Landlord for the period commencing on the date of receipt of Tenant’s Notice and ending on the date set forth in Landlord’s Notice as the effective date of the assignment or surrender of the Demised Premises, as the case may be. In the event of an assignment

19

of this Lease to Landlord, provided Tenant has paid all of the Rent due hereunder (including any Recapture Rent) as a condition to such assignment, on the effective date of such assignment this Lease shall terminate and Landlord and Tenant shall be released from all liability accruing thereafter under this Lease as if such date were the Expiration Date originally set forth herein. In the event of a surrender of a portion of the Demised Premises, on the effective date of such surrender this Lease shall be modified to reflect the reduced floor area of the Demised Premises and the corresponding reductions in the payment of Rent and Landlord and Tenant shall be released from all liability accruing thereafter under this Lease with respect to such portion of the Demised Premises. The sending of Landlord’s Notice shall, ipso facto, and without the necessity of any further act or instrument, be sufficient to effectuate said assignment or modification. However, if Landlord shall request, Tenant shall execute such documents as Landlord may reasonably request in confirmation thereof. Notwithstanding Landlord’s consent on any one occasion, the right to recapture as aforesaid shall apply to any further subletting or assignment.

(ii)“Tenant’s Notice” shall include all of the following information, to the extent Tenant’s Notice relates to a subletting or assignment transaction contemplated by Tenant and such information is available to Tenant:

|

|

(1) |

a statement by Tenant that the proposed sublease or assignment is a bona fide transaction and that Tenant and the proposed assignee or sublessee are ready and willing to enter into such sublease or assignment agreement, subject to reasonable conditions; |

|

|

(2) |

the legal name of the proposed assignee or sublessee, and the name under which such assignee or sublessee proposes to conduct business; |

|

|

|

(3) |

the rent and other proposed business terms of the proposed assignment or subletting; |

|

|

(4) |

the proposed business to be conducted by such assignee or subtenant; |

|

|

(5) |

current financial statements of the proposed assignee or subtenant (or the proposed guarantor thereof); and |

|

|

(6) |

the names, addresses and telephone numbers of the officers and principals of the assignee or subtenant in question. |

Landlord shall have the right without any liability to Tenant whatsoever, to negotiate directly with the proposed assignee or subtenant in question.

(iii)If Landlord accepts Tenant’s offer to surrender a portion of the Demised Premises (such portion of the Demised Premises is hereinafter referred to as the “Subdivided Premises”), Tenant shall notify its proposed sublessee of Landlord’s decision (and Landlord shall have the right to negotiate with any proposed subtenant or assignee without any liability whatsoever to Tenant). Tenant shall promptly commence to subdivide the Subdivided Premises to a separate space using “building standard” materials and Tenant shall perform such work in compliance with code (“Subdividing Work”). The Subdividing Work shall be performed by Tenant in accordance with plans and specifications approved by Landlord which approval shall not be unreasonably withheld, delayed or conditioned and which plans and specifications will make provision for necessary separate utilities, demising wall(s), and all work necessary to make the remainder of the Demised Premises into separate premises independent of the Subdivided Premises. Tenant shall not be responsible or liable for the cost of any work performed in or to the Subdivided Premises. Tenant shall promptly upon

20

approval of said plans and specifications by Landlord, commence to perform such work and shall secure all permits as may be required in connection with the performance of the Subdividing Work and all of such work shall be promptly completed in a good and workmanlike manner.

(c)In the event that Tenant sends a Tenant’s Notice and Landlord does not exercise the right of recapture as set forth in subsection 10.01(b), then Tenant may, without Landlord’s further consent, assign this Lease or sublet all or the portion of the Demised Premises which was the subject of the Tenant’s Notice within six (6) months after Landlord fails to recapture pursuant to the previous subparagraph, provided the following terms and conditions are fully complied with:

(i)Tenant shall not be in Default under this Lease at the time Landlord’s consent is requested or at the effective date of the assignment or subletting.

(ii)The Demised Premises shall be used by the assignee or subtenant subject to and in accordance with the provisions of Article IX; and for no other purpose.

(iii)Tenant shall pay to Landlord a sum equal to (1) fifty (50%) percent of any rent (on a per square foot basis) or other consideration (on a per square foot basis) paid to Tenant by any assignee or subtenant which is in excess of the Rent (on a per square foot basis) then being paid by Tenant to Landlord pursuant to the terms of this Lease, and (2) fifty (50%) percent of any other profit or gain realized by Tenant, as additional rent immediately upon receipt thereof by Tenant. Tenant may deduct from any such payments to Landlord fifty (50%) percent of Tenant’s alteration costs and brokerage fees, incurred with respect to any such assignment or sublease.

(iv)In the case of an assignment, it shall provide for the assignment of Tenant’s entire interest of this Lease and the acceptance by the assignee of said assignment and its assumption and agreement to perform directly for the benefit of Landlord all of the terms and provisions of this Lease on Tenant’s part to be performed.

(v) In the case of a subletting, it shall be expressly subject to all of the obligations of Tenant under this Lease and the further condition and restriction that the sublease shall not be assigned, encumbered or otherwise transferred or the subleased premises further sublet by the sublessee in whole or in part, or any part thereof suffered or permitted by the sublessee to be used or occupied by others, without the prior written consent of Landlord in each instance.

(vi)There shall not be more than one (1) sublease in effect covering the Demised Premises at any time during the Term and the Demised Premises shall not consist of more than two (2) separate premises at any time, one of which must consist of at least 20,000 square feet of floor area (exclusive of any mezzanine).

(vii)The proposed subtenant shall have a tangible net worth at the time of the subletting of at least ten times the Rent then payable under the proposed sublease.

(d)Landlord shall be furnished with a duplicate original of the assignment or sublease within: (i) thirty (30) days after its execution or (ii) prior to its effective date, whichever is earlier.

(e)Anything contained in this Article X to the contrary notwithstanding, Tenant shall have the right to assign this Lease or sublet the Demised Premises (i) to an entity which is a parent, affiliate or subsidiary of Best Buy Stores, L.P. or Best Buy Co., Inc.; or (ii) to an entity which is a successor to Best Buy Stores, L.P. (including its subsidiaries and parent), by way of merger, consolidation or corporate reorganization, or by the purchase of substantially all of the assets of Best Buy Stores, L.P. (including the

21

assets of its subsidiaries and parent); or (iii) to an entity which purchases all of the stores owned and operated by Best Buy Stores, L.P. and its subsidiaries, affiliates and parent, provided that any such transaction [as set forth in subsections 10.01(e)(ii) and (iii)] includes at least seventy-five (75) locations operated similarly to the Demised Premises, without obtaining Landlord’s prior written consent thereto; provided: (a) Tenant is not then in Default under the terms of this Lease; (b) within a reasonable time after the execution of any such assignment or subletting, a fully executed and acknowledged assignment or sublease agreement, is delivered to Landlord, which assignment shall contain an assumption agreement by the assignee in favor of Landlord of the terms and provisions of this Lease; and (c) Tenant shall remain liable under this Lease. In the event of any such assignment or subletting as set forth in the preceding sentence, Landlord shall not have the right to recapture the Demised Premises as elsewhere provided in this Article X.

(f)If Tenant is a corporation or partnership, and if at any time during the Term the person or persons who, on the date of this Lease, owns or own a majority of such corporation’s voting shares or such partnership’s partnership interest, or such limited liability company’s interest, as the case may be, ceases or cease to own a majority of such shares (whether such sale occurs at one time or at intervals so that, in the aggregate, such a transfer shall have occurred), or interest, as the case may be, then in any such event Tenant shall so notify Landlord and Landlord shall have the right, at its option, to terminate this Lease by notice to Tenant given within thirty (30) days thereafter or within ninety (90) days after Landlord shall have received other notice thereof, except that this Section shall not be applicable to any corporation, the majority of the outstanding voting stock of which is listed on a national securities exchange (as defined in the Securities Exchange Act of 1934, as amended) or is otherwise publicly traded. For the purposes of this subsection 10.01(f), stock ownership shall be determined in accordance with the principles set forth in Section 544 of the Internal Revenue Code of 1986, and the term “voting stock” shall refer to shares of stock regularly entitled to vote for the election of directors of the corporation. The foregoing provisions of this subsection 10.01(f) shall not apply to the transfer of corporate shares or partnership interests in connection with a transaction permitted pursuant to subsection 10.01(e)(ii).

Section 10.02 Master Lease:

Tenant acknowledges that it has been informed that Landlord may hold a leasehold interest in the Demised Premises under a Master Lease.

Section 10.03 Subordination:

(a) This Lease shall [subject to subsection 10.03(b)] be subordinate to the lien of any present Mortgage [which term (“present Mortgage”) shall be deemed to include, without limitation, any spreading agreements, renewals, modifications, consolidations, future advances, replacements and extensions thereof] or future Mortgage or Master Lease irrespective of the time of recording of such Mortgage or Master Lease. However, from time to time, Landlord may elect that this Lease be paramount to the lien of such Mortgage, and may exercise such election by giving notice thereof to Tenant, which notice must be concurred in by such Mortgagee. The exercise of any of the elections provided in this Section shall not exhaust Landlord’s right to elect differently thereafter, from time to time. This clause shall be self operative and no further instrument shall be required, however, upon Landlord’s request, from time to time,Tenant shall [subject to subsection 10.03(b)] (i) confirm in writing and in recordable form that this Lease is so subordinate or so paramount (as Landlord may elect) to the lien of any Mortgage or Master Lease and/or (ii) execute an instrument making this Lease so subordinate or so paramount (as Landlord may elect) to the lien of any Mortgage or Master Lease, in such form as may be required by an applicable Mortgagee or Master Lessor.

22